Learn to Trade Emini Futures - FOMC Statement 01/25/12

January 25, 2012 at 4:45 PM

January 25, 2012 at 4:45 PM (QQQQ)(DIA)(SPY)(GLD)(SLV)

Fed Chariman Ben Bernanke speaking today at a press conference stated that recent signs of strength in the economy do not rule out further quantitative easing measures if warranted."We not ready to declare we've entered a new stronger phase" in the economy, Bernanke said in his press conference. Many economists believe economic growth will slow again in the first half of the year after what looks like a very good fourth quarter.

If the economy falters or if deflationary pressures continue to mount, the Fed would consider further purchases of assets such as Treasurys or mortgages. "That option is certainly on the table," Bernanke said.

Gold, which had traded in negative territory through most of the session, surged on the Fed’s statement. While few expected Chairman Bernanke to give markets a third round of quantitative easing, several asset classes responded to what can be seen as additional easing.

The yellow metal went from trading at an intraday low of $1,649.60 around 9:40 AM in New York to a peak of $1,714.90 an ounce by today's close. Rates on 10-year Treasuries plunged even further, trading down 5.14% to 1.96%.

A dovish Fed has proven to be a bullish catalyst for gold as of late. UBS’ Edel Tully noted a further extension of the time frame in which the Fed expects to keep rates in the 0% to 0.25% range is “likely to be considered as a form of easing in lieu of balance sheet expansion by most FOMC members.”

But the major factor will be “any clues that point toward additional stimulus.” Despite what many economists have agreed is a stronger than expected economic performance by the U.S., the FOMC statement retained its previous pessimism. Not only do unemployment rates remain high, “but growth in fixed investment has slowed and the housing sector remains depressed.”

The biggest risk to the anemic recovery, though, comes from aboard, particularly Europe. “Strains in global financial markets continue to pose significant downside risks to the economic outlook,” read the FOMC Statement.

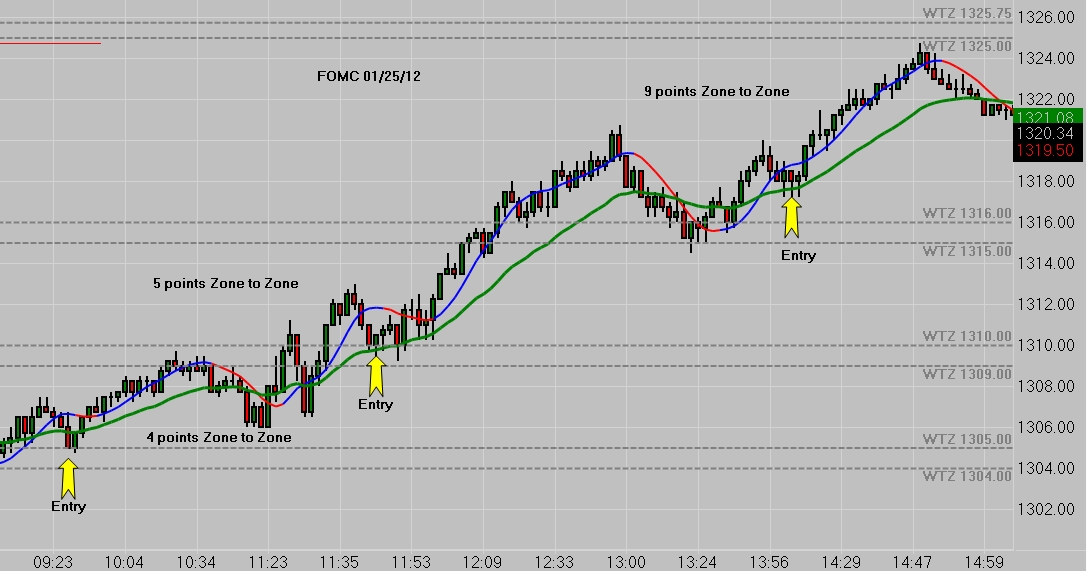

S&P 500 Emini Futures Chart of the Day

S&P 500 Instant Replay

Globex 01/24/12

Price rallies to 1309 WTZ on European Open and drops to 1305 WTZ

Globex 01/25/12

Price rallies to 1309 WTZ on European Open and drops to 1305 WTZ

Do these types of scenarios often repeat? They do. Tomorrow night in the Partner's Meeting we will discuss patterns and how they apply in our Emini Trading. 9PM EST.

5 Day FREE Trial - Platform / Data / Indicators / Training

Reader Comments