Dow Closes Above 13,000 - Emini Futures Podcast

February 28, 2012 at 4:33 PM

February 28, 2012 at 4:33 PM (QQQQ)(DIA)(SPY)(GLD)(SLV)

The Dow closed today above 13,000 for the first time in 3 years. As it did twice last week and on Monday, the Dow poked through the 13,000 level in intraday trading on Tuesday but then dropped back down toward the end of the day before a final surge that pushed it up to about 13,005. The S&P 500 Cash index closed above it's high-water mark to settle at 1372.18.

Dow - Range Trading

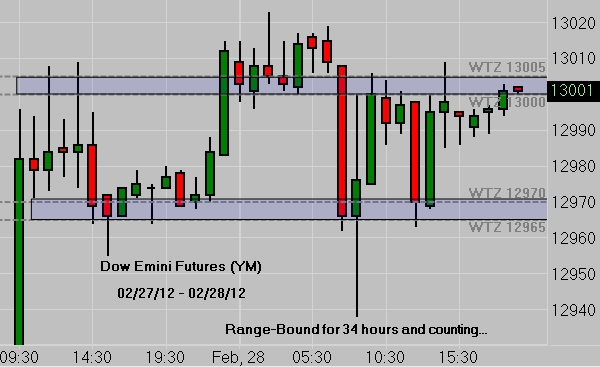

It was no easy task for the Dow to finally close above 13,000 and the fact that it did is no guarantee it will remain there. Following is a chart of the Dow Emini Futures -

Dow Emini Futures (YM) 02/28/12

Monday morning the Dow Futures entered a 30 point trading range @ 10:30AM CST and have remained inside of that range with the exception of a few short lived spikes for the past 34 hours. To put this in perspective, a 30 point range on the Dow Futures is equivalent to a 3 point range on the S&P 500. It just so happens that the top and bottom of the trading range are both CFRN Weekly Trading Zones.

The emini chart above is hourly. Each candle represents one hour of trading on the 24 hour Globex clock. The emini charts below are volume charts. Through the use of volume charts CFRN Partners are able to see how price reacts in and around our Weekly Trading Zones. When the market approaches a Zone we expect price to either be rejected or accepted. However, in most cases what we see first is consolidation. On the hourly chart above you saw price consolidating between 2 Weekly Trading Zones. The charts below will highlight the consolidation we've seen at both the top and bottom of the range inside the Zones themselves. This is typical behavior and one of the first things we teach in our Live Emini Trading Room.

Dow Emini Futures Top of Range Consolidation 02/27/12

Dow Emini Futures Top of Range Consolidation 02/27/12

Dow Emini Futures Bottom of Range Consolidation 02/28/12

Dow Emini Futures Bottom of Range Consolidation 02/28/12

Dow Emini Futures Continued Consolidation 02/28/12

Dow Emini Futures Continued Consolidation 02/28/12

Dow Emini Futures 02/28/12

Dow Emini Futures 02/28/12

The spring is coiled pretty tightly here. One would naturally assume that since we closed above the 13,000 mark on the Dow that the blast off will most certainly be to the upside. I won't discount the possibility. Do however, observe the fact that after a week of attempting to close above the key psychological level we did so with more of a whimper than a wallop. Whichever way she breaks, we have laid the foundation for some very nice volatility up ahead. Volatility equals cash flow.

Please leave a review on iTunes

5 Day FREE Trial - Platform / Data / Indicators / Training

Reader Comments