Fibonacci Extensions For Emini Traders

October 24, 2012 at 10:25 PM

October 24, 2012 at 10:25 PM (QQQ)(SPY)(GLD)(FB)(YHOO)

“When in doubt, predict that the present trend will continue.” Merkin's Maxim

Understanding Fibonacci Extensions For Emini Trading

In our first article Fibonacci Tips For Emini Futures Trading we discussed the application of Fibonacci Retracements in the context of an uptrend. In the second article of the series Fib Tips For Emini Traders - Part 2 we discussed the same principles with a focus on their application in the context of a down trend. Both articles are complete with chart examples and in Part 2 we also used a Live Blogging format during the Sunday night Globex open. The purpose of the exercise was to move away from a purely historical chart and give you real world exposure to the Hard Right Edge.

In the third and final installment of this series we will take a look beyond the hard right edge and examine how we might use Fibonacci to help project possible targets for the next leg of an uptrend or a down trend. Fib extension levels, are based on the Golden Ratio just as our retracements were and we will plot them as horizontal lines either above or below current price action.

Fibonacci Extensions In An Uptrend

In an uptrend your goal is to establish potential points for taking profits at Fibonacci Extension Levels. To determine the levels that you will use:

#1) Click on a significant Swing Low

#2) Drag your cursor up and click on the most recent Swing High.

#3) The final step is to drag your cursor down and click on the retracement Swing Low.

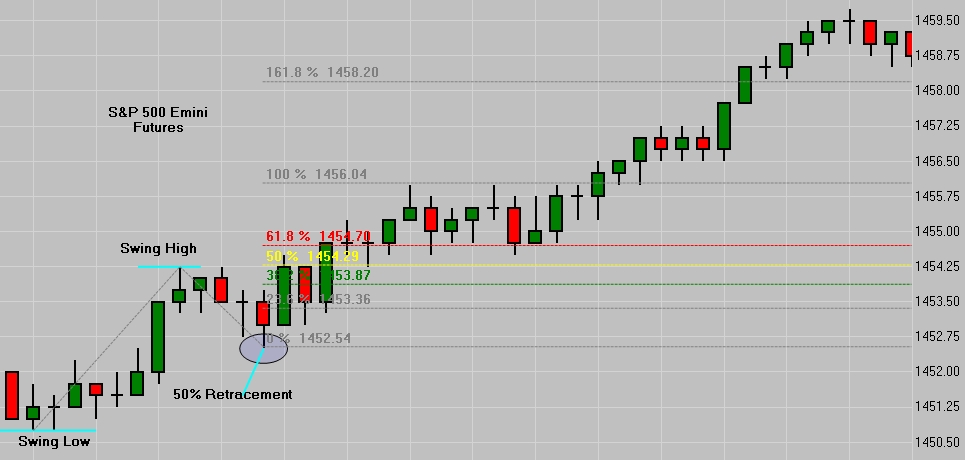

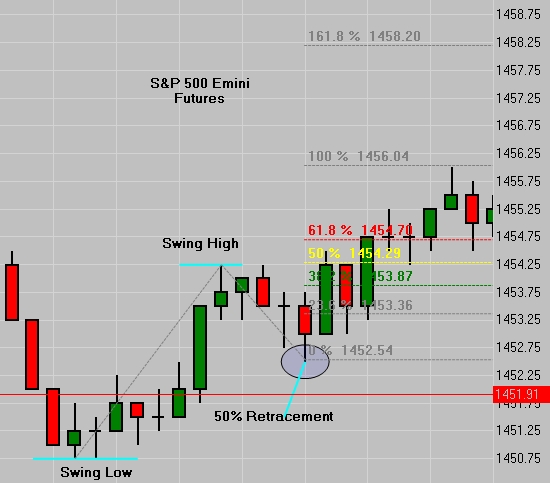

Your Fibonacci Extension Tool which is built into dtPro and most other trading platforms, will now display each of the targets including the ratio as well as the corresponding price level. Here is an example:

(ES) S&P 500 - Fibonacci Extensions

In the chart above we can see that out significant swing low was at 1450.75. Price rallied to 1454.25 which became the significant swing high prior to the retracement. Remember, we want to see at least a 38% retracement. There is a shallow retracement level at .236 which you may choose to use in your Emini Trading Business. We have found that retracements which fall between the 38% and 62% levels create the best opportunities for our trading model. With a little patience and experimentation you will decide whether or not you want to include this level on your chart or not. Adding it is very simple, simply double click on one of the fib levels and the Properties dialog box will open.

Using our Fibonacci Retracement Tool we have already established that from the swing low to the swing high, 1452.50 represents a 50% retracement. Once the retracement is in, we use our Fib Extension Tool to calculate likely price targets for our long trades based on the Golden Ratio or Fibonacci Sequence. Since we are dealing with a 50% retracement, a 50% fib extension takes up right back to the swing high at 1454.25. In this example that would be a move of 1.75 points. A 62% fib extension says the market can rally to 1454.70. A 100% fib extension which is equal to the distance from the swing low to the swing high would send price up to 1456.00 which in this example is exactly what happened. This represents a move of 3.5 points.

This example is on a smaller time frame, in fact this is the standard volume chart that we trade from in the Live Trading Room. While 3.5 points may or may not seem like a substantial move to you, any day that we capture 2 points net is considered a day well done. We have an occasional guest on our Daily Radio Program who averages trading 10k Emini Contracts per day. When asked on live radio what he considered to be a "good day" in the market, his reply was that any day he netted 2 points in the S&P Emini he considered that to be a great day. If you would like to listen to some of the archived interviews Google - "Michael X CFRN" or "Trader X CFRN". He is a very low key and likeable guy, not what you might typically expect from someone who has a daily goal of earning a million dollars.

Back to my point, whether or not you understand the power of 2 points net per day, compounded on a consistent basis, let's simply look at the trade above based on it's own merits. How big was the risk required? Because we are in a smaller time frame, we have the luxury of placing a buy limit at the 38% retracement level. What if it retraces to the 50 or 62% level? Look at the numbers:

- 38% = 1452.92 which rounded up to the nearest tick is 1453

- 50% = 1452.50 we don't need to round this number

- 62% = 1452.09 which we will round down to the nearest tick at 1452

Here's my point, from the 38% level all the way down to the 62% level is exactly 1 point. We always like to have at least a couple of ticks for "breathing room" as they call it, so in this example placing a limit order to buy at 1453 would have allowed you place your stop loss 2 ticks under the 62% level so the total risk on the trade would be 1.5 points. Anytime I spot an opportunity in the market to risk 1.5 points for a potential profit of 3.5 points is a situation that I find very compelling because if there is any sign of weakness beyond the 1.5 to 2 point mark I can gracefully exit the market with pep in my step and a profit in my pocket.

If we look farther up the chart there is another fib extension at 161.8%. Is it possible the market could actually move that far on a trade where you have skillfully reduced your risk to a mere 1.5 points? Great question! Let's have a look -

(ES) S&P 500 - Fibonacci Extension 161.8%

(ES) S&P 500 - Fibonacci Extension 161.8%

The answer is obviously a resounding Yes! Are there extensions above the 161.8% level? Yes there is. Did we skip over the 138.2% level? Yes we did. I would like you to attempt to re-create this chart or a similar chart and project price targets using the Fib Extension Tools. I also want you to open the properties of the tool as previously discussed and include the 138.2% level. If you will complete this simple exercise, you will be well on your way to learning to use Fibonacci as both a confirmation and projection tool in your Emini Trading Business. One final note on this chart, once the rally was over, look at the candlestick that marked the end of the advance; our friend the Doji.

Fibonacci Extensions In A Down Trend

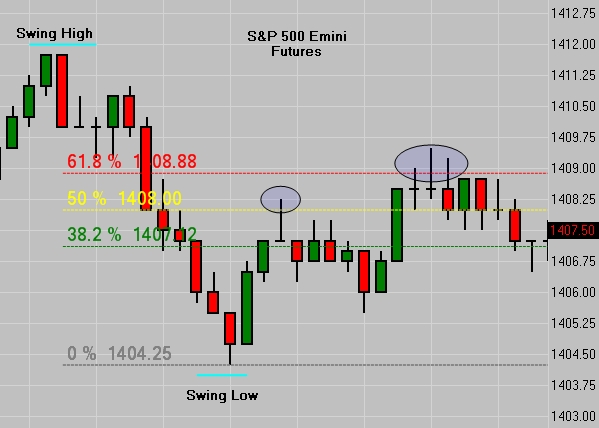

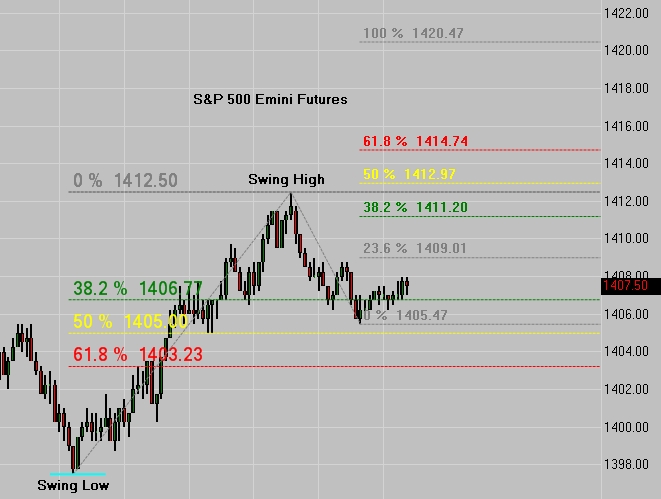

I will now show you an example of using the Fib Extension Tool to project potential price targets in a down trend. All steps are simply reversed. First we use our Fib Retracement Tool to determine at what price we might anticipate the market reversing the counter trend move and continuing with the down trend. If you need help with the steps, refer to the previous 2 articles referenced at the beginning of this post or give us a call.

(ES) S&P 500 - .618% Retracement

(ES) S&P 500 - .618% Retracement

We have clearly established that our swing high is 1411.75 and our swing low is 1404.25, a total move of 7.5 points. Without even using the tool we can quickly calculate in our head that 50% of 7.5 is 3.75 points. On the first leg up price does in fact run right to the 50% fib level, stumbles a bit, and then resumes the move right up to the 62% fib level. The 62% retracement is 1408.88. The swing high of the retracement is 1409.50.

The distance between the 38% level and the 62% level is roughly 2 points as both numbers need to be rounded to the nearest tick. If you entered at the 38% level on a limit, and placed your stop 2 ticks above the 62% level, you would have been stopped out "to the tick". Notice again that our friend, the Doji, signals that the party is over, for now. You will ultimately need to assess you own risk profile. You must determine based on your account size, experience and temperament, how much you are willing to risk on any one trade. If you would like some help fine tuning your risk profile call Burt or Leslie at 866-928-3310 and they will be happy to assist you.

If you used a stop 3 ticks above the 62% level you're still in the trade. If you entered at the 50% level, the market actually moved down 2.5 points before it completed the pull back to the 62% level. Now that we have 3 key pieces of information -

- Swing High

- Swing Low

- Retracement High

We are ready to project our price targets on the down side. This is where you will shift to your Fibonacci Extension Tool and follow the instructions above by simply reversing the order. When you are done it should look something like this -

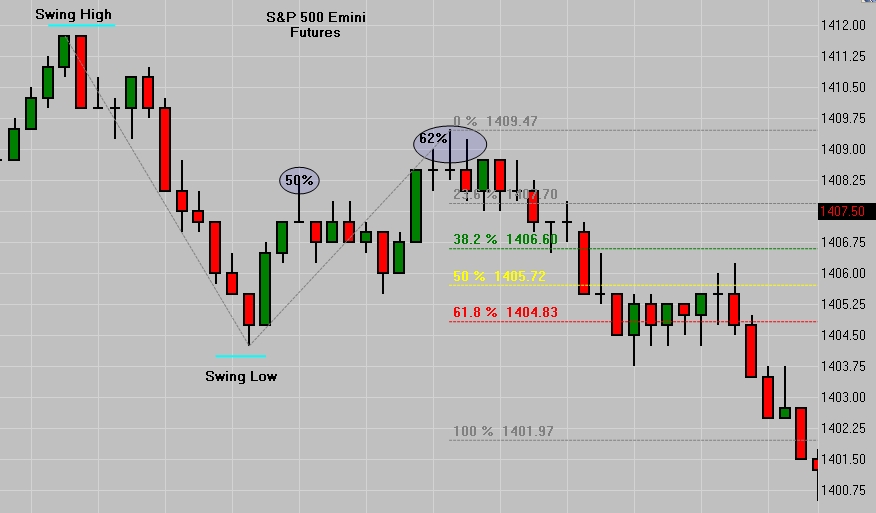

(ES) S&P 500 Fibonacci 100% Extension

(ES) S&P 500 Fibonacci 100% Extension

We know that price pulled all the way up to the 62% fib retracement level at 1409.50. Here are our targets on the way down -

- 38% extension = 1406.75 or 2.75 points

- 50% extension = 1405.75 or 3.75 points

- 62% extension = 1405.00 or 4.50 points

- 100% extension = 1402.00 or 7.50 points

Does 7.5 points sound familiar? That was the size of the original move down from the swing high to the swing low. A 100% fib extension simply duplicates the size of the original leg. Is there more?

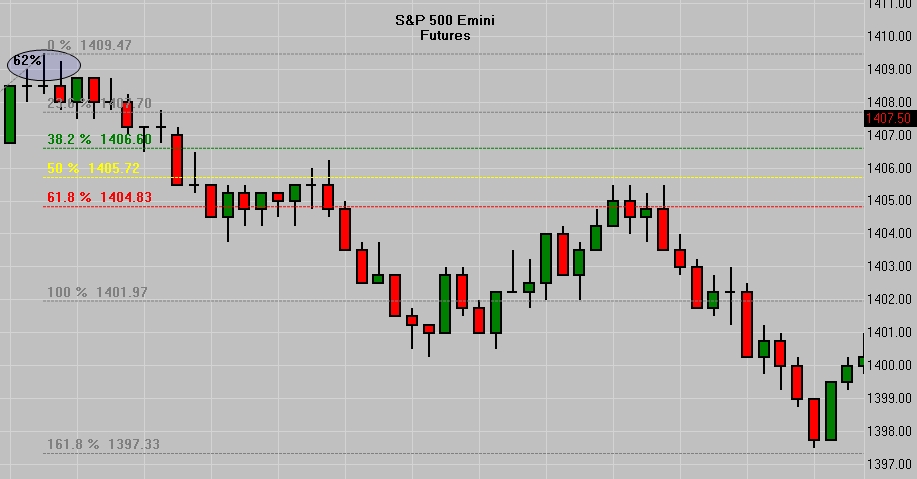

(ES) S&P 500 Fibonacci Down Trend Extension 161.8%

(ES) S&P 500 Fibonacci Down Trend Extension 161.8%

Price bounces around the 100% fib extension at 1402 and then moves back up to the 61.8% extension at 1405. Look left and notice how we are challenging not only the original swing low but also the area created by the original move down to the 61.8% level. This is an example of Support becoming resistance as detailed in our article Learn to Trade Emini Futures - Support And Resistance. From the 62% fib retracement level to the 161.8% fib extension level the market dropped a total of 12 points.

This completes our 3rd and final installment of Fibonacci Tips For Emini Futures Trading. If you have any questions or would like to arrange private instruction please give us a call or drop us an email. I will leave you with a chart on the hard right edge of the current market. The markets are closed for the weekend so be sure to watch the Globex open Sunday night and see what happens to the following fib retracements and projections.

(ES) S&P 500 Emini Futures - Fib Retracements and Price Targets

(ES) S&P 500 Emini Futures - Fib Retracements and Price Targets

If you need a platform and charts to watch the Globex open, download it Here.

As opportunities unfold we will keep you posted.

Questions?

Call us toll free @ 866-928-3310 during normal business hours.

After Dark - email support@cfrn.net or call 415-857-5654

Please leave a review on iTunes

5 DAY FREE TRIAL

emini futures,

emini futures,  fibonacci extensions

fibonacci extensions

Reader Comments