Our Concierge Emini Trade Alert Service

Has Officially Launched!

We have had more requests from both Professional and Retail Traders for this type of service over the past 9.5 years than any other service we've ever offered. It was Monday's announcement however, that revealed just how closely we were being followed. We had failed to factor in those who used the data daily without registering. A very nice surprise and even more surprising, we scaled quickly and met the requests.

Trading For A Living

Trading's not easy, but it can be simple!

That has been our company motto for many years. We've always believed the simplest and even fastest way to the destination - "trading for a living", is to "Learn How To Trade". Unfortunately, many people don't want to Learn. They simply want someone to either call out live when to enter and exit, or buy a magical device that does the same thing. If you're reading this, chances are you've tried both at some point. If it had worked... you wouldn't be reading this now.

Please don't think we're talking down to anyone. Michael and I are just as guilty as anyone and everyone else. What we didn't buy, we wrote and coded ourselves. Suffice it to say, after several trips around Trader Mountain, we decided it was time to learn how to trade.

Years ago Emini Indicators and Oscillators were all the rage. As those went out of vogue in came Pure Price Action and all Indicators and Oscillators were promptly burned at the stake. In fact, the interview I did with Dr. Al a few years ago, really helped to stoke the flames of that great resurgence. Yes I said RE-surgence, because it is a cyclical beast. Other fun things in the cycle are things such as "Read the Stars Not the Bars", which means take your eyes of the chart and look to the sky. Counting candles is another one and of course we have every other method from Market Profile to Elliot Wave, Fibonacci to Lucas, and the list goes on...

Attention on deck: "I'm not knocking any of them". I believe there is some validity in each and every one of them. Quite frankly, all things work some of the time, nothing works all of the time. Period. For those of you who have been tuning in to CFRN Radio for the past 9+ years, know I have a real problem with the term "works". Not a Maynard G Krebbs issue, but an issue which is used to mislead people.

If you asked any vendor on the Internet the following question -

"Does your system, methodology, indicator, oscillator work?"

If that vendor replied "Yes, it most certainly does, some of the time." I would have tremendous respect for that businessman. In fact, I would be willing to nominate or cast a vote for such a person. Integrity is sorely lacking in our industry, but the man who is willing to honestly say "some of the time", deserves recognition because he has Integrity!

Learn How To Trade Emini Futures And All Other Markets

When someone asks us that question, we are very careful how we answer it. Our goal is to teach you how to trade. If we succeed in teaching and you succeed in learning, then you have gained a life skill which can never be taken from you. Does that mean you'll get rich or make loads of cash every single day? No. It means you know how to trade. It means you can read a chart. It means you can look at the evidence in front of you and know whether or not you have a trade in front of you which offers a definable edge and carries with it a high probability for a proper outcome.

If it does not turn out as hoped, it may not be your fault at all. You read the chart, assembled and assimilated all the facts in front of you, determined what the hive mind was most likely to do, and you placed your trade based on those facts. Not on a whisper, an indicator, an oscillator, or a falling star. Now if an indicator or oscillator is part of the overall manner in which you solve the puzzle - Awesome. However, you must have a basic understanding of what's really going on. This is what we call... "Learning How To Trade".

Once you "Learn How To Trade" there are many tools and techniques which will help you solve the case and post a profitable trade. All the tools in the world are weapons of mass destruction without a basic understanding of "How Markets Work".

Why Is Our Trading Method Different?

Our Methodology embraces the underlying rhythm of the market. Our indicators are like fancy reading glasses. They simply help you see more clearly, what's already right in front of you. This is why, 9+ years later we are still around, still mentoring many successful Traders, and we've now introduced a somewhat different solution to the Trading conundrum.

Many people desperately want to learn how to trade, but they don't have the time. Our Mentoring Program is 90 days and they don't have 90 minutes. So after producing a 3 year public track record, we have launched our Concierge Trade Alert Service.

The premise is quite simple. We email each client 5-8 Trade Alerts each day, they select the markets they actually trade, get their charts ready.... and when it's time, they execute and manage the trade. For those still holding down a day job, it's beautiful. Most days our Partners and Clients can reach their daily goal off the London Open. That's Midnight Pacific Time and 3am Eastern. Yes, it will interrupt the circadian cycle, but many days between 3 and 4am Eastern, you're done for the day and can possibly still catch 89 winks before the alarm.

Why The Name - Concierge Trade Alert Service

- Why the name? Concierge in the past few years has taken on a much different meaning from what you will find in Webster. In days gone by, he (the Concierge) was simply the gentleman at the High Class Hotel who had a guy for everything. No matter what your hearts desire, from show tickets to a sold out Broadway Play, dinner at a restaurant with a 2 year waiting list, a dozen roses @ 3am or even an 1865 Château Lafite served rooftop at Sunrise, (plus of course, things we won't discuss here). He had it, got it, or found a reasonable substitute with class, panache and of course... discretion.

Do You Have A Track Record For Your Alerts?

Yes! We've been moving towards this launch for over 3 years now. Quietly plodding along, somewhat under the radar, Tweeting, Alerting, laying down our Public Track Record. Not on our web site of course, but on Public Venues where there is unquestionable transparency.

Below we are going to post the results for the month of October 2014. The initial list will be just for the S&P500 Emini Futures. We do send out 5-8 Alerts each night (all in one email when possible), so I will be adding the results of the other markets over the next few days.

What you will see is every Alert we emailed to Partners and Concierge Clients in October and the results "Good Bad or Ugly" of each and every Alert. We do have a few ground rules for the Alerts so let me lay those out first.

- We only risk 8 ticks on each Alert. We also teach aggressive risk management once you are in a trade. You will determine how aggressive you want to be.

- Our daily goal is $100 per contract per day. If you get 10 ticks in Crude, you're done. If you get 5 ticks in Crude and 5 ticks in the S&P, you're done. At first it may be difficult to exercise the discipline required to walk away with only $100, but as time passes... those additional contracts you've added with profits you earned in the market, make it easier by the day.

- We do believe in trailing our stops. We like to get to break even plus a tick as soon as we can. If you have 7 ticks in Gold, that's 70% of your daily production. Give it some room as you trail, but never ever allow a trade which has given you 70% of your daily production become a liability on the balance sheet.

- Never chase an Alert. There are too many Alerts and too many opportunities. In fact. "important prices and important areas are almost always tested. What does this mean? If you have an Alert that triggers and runs to target quickly... chances are it will trigger again.

- Anytime price rises above an Short Alert price or drops below a Long Alert price, there is a high probability that you will see the original trade unfold again. If the move is at least one tick, above or below, we consider that sufficient to qualify the trade as having been reset. However, if you already have your Daily Goal, it's not important to you. In no way are you obligated to take the trade again. Even though many days we will see the exact same Trade Alert trigger 3-4-5 even 6 times and more. 90% of the time, you will simply ignore it.

- Finally - you have one goal and only one goal. Use these Alerts and what we teach you to earn $100 per contract, per day. Period. Once you add the second contract it becomes $200 a day. After the third it becomes $300 a day, etc... You will see 20 to 50 Alerts trigger on most days, your biggest challenge will be to resist the temptation to do what you are not yet ready for.

- Be Patient! We'll get there together...

Trading Involves Risks

Keep in mind, past performance is no guarantee of future results. Trading is risky and you could lose all of your money. Never trade without a hard stop. We personally never risk more than 8 ticks on any trade.

S&P 500 Emini Trade Alerts And Results For October 2014

Tuesday 09/30/14 11:35am PDT

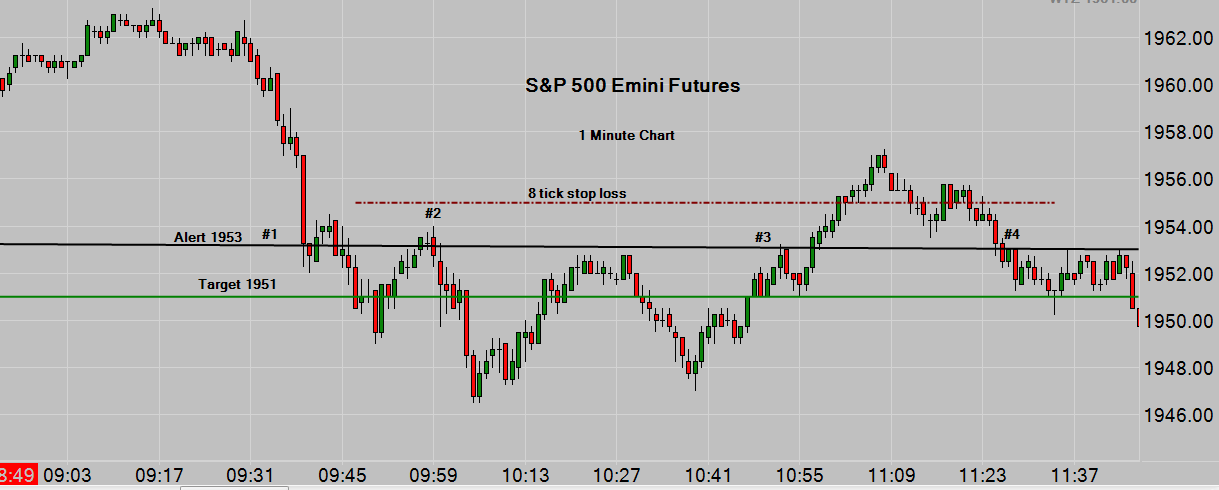

ES - consider being short below 1953 if the opportunity presents.

Results - Initial trigger was at 9:44am EDT. It took 3 minutes to hit our 2 point $100 target. #2 triggered at 9:59 and hit the target at 10am EDT. #3 triggered at 10:52am EDT. Remember if prices rises even 1 tick above the Alert Price, it "resets" the trade and we are good to go again. Also note that while you could have trailed a stop beyond the target on #1 and #2, #3 did not trade THROUGH the target. This means unless you took your profit, there is not guarantee you were filled. Always be on the lookout because this happens quite often. On #4 you must be triggered in before you can be stoppd out. Therefore, #4 was just fine and the only reason we didn't have a number 5, is because price only rose to 1953. We needed it to go 1 tick higher in order to officially "reset" the trade. Swing low of the day was 1934 I believe.

Remember, if you caught the first one.... nothing else mattters. Kapeesh?

Additional Emini and Futures Charts Available on our Google Plus Page

Additional Emini and Futures Charts Available on our Google Plus Page Wednesday 10/01/14 12:27am PDT

ES - We already have a short Alert in place for the ES, on the long side - consider being long above 1972, if the opportunity presents. Specifically the trade I see if we get up there is, 1972 to 1974. However, I know leaving the target side open is beneficial for many of you if only on a psychological level. As always we only have one goal each and every day, that's to make $100 per contract. For the 1 contract trader, that's $100. For the 10 contract trader, well that's $1,000.00 and so forth and so on...

More detals ansd charts https://plus.google.com/u/0/109532057484296548607/posts/B1EqwdW7aXE

Thursday 10/02/14 12:21am PDT

ES - consider being short below 1939 if the opportunity presents.

Sunday Night 10/05/14 Globex Open 3:25pm PDT

ES - consider being short below 1957 or long above 1968, whichever presents first.

Monday Night 10/06/14 4:30pm PDT

ES - consider being short below 1948 or long above 1956, whichever presents first.

Tuesday Night 10/07/14 11:00pm PDT

ES - consider being long above 1938 or short below 1929, whichever presents first. If you miss the short side @ 1929, consider being short below 1922 if the opportunity presents

Wednesday Night 10/08/14 11:52pm PDT

ES - consider being short below 1958 or long above 1972, whichever presents first.

Thursday Night 10/09/14 11:45am EDT

ES -consider being long above 1929 or short below 1912, whichever presents first. If price moves up and stalls at the WTZ 1926/1927, consider being short below 1923 (only after touching the Zone)

Sunday Night 10/12/14 Globex Open 5:25pm PDT

ES - consider being long above 1889 or short below 1878, whichever presents first.

Monday Night 10/13/14 5:00pm PDT

ES - consider being long above 1871 or short below 1858, whichever presents first.

Tuesday Night 10/14/14 4:45pm PDT

ES - consider being long above 1886 or short below 1874, whichever presents first.

Wednesday Night 10/15/14 7:46pm PDT

ES - consider being long above 1854 or short below 1841, whichever presents first.

Thursday Night 10/16/14 8:45pm PDT

ES - consider being short below 1856 if the opportunity presents.

Sunday Night 10/19/14 11:59pm PDT 2:59am EDT

ES - consider being long above 1894 or short below 1887 (current price 1888.25)

Monday Night 10/20/14 8:30pm PDT 23:30 EDT

ES- consider being short below 1892 or long above 1907, whichever presents first.

Tuesday Night 10/21/14 8:00pm PDT 23:00 EDT

ES- consider being short below 1934 if the opportunity presents

Wednesday Night 10/22/14 7pm PDT 19:00 EDT

ES - consider short below 1920 or long above 1937

Thursday Night 10/23/14 11:35pm PDT 2:35am EDT

ES - consider short below 1928 or long above 1960

Sunday Night 10/26/14 4:15pm PDT 19:15pm EDT

ES - consider short below 1955 or long above 1967, whichever presents first.

Monday Night 10/27/14 7:30pm PDT 22:30 EDT

ES - consider being short below 1941 or long above 1970, whichever presents first.

Tuesday Night 10/28/14 7:05pm PDT 22:05 EDT

ES - consider long above 1982 or short below 1967

Wednesday Night 10/29/14 6:20pm PDT

ES - consider long above 1975 or short below 1964

Thursday Night 10/30/14 8pm PDT 23:00pm PDT

ES - consider being long above 1997 or short below 1984

As discussed recently both on the Blog and Radio Show, many people who desire to learn how to trade, simply can't find the time. At the end of the day... there just aren't enough hours. Sound familiar?

Concierge Trade Alert Service

This service works well for both new Traders and Seasoned Veterans. Over a 24 month period those in our mentoring program who chose to trade our 24/20 Blueprint, have the opportunity to progress in a controlled manner from 1 to 20 contracts, using only profits they have earned in the market.

If you're already trading 5 or 10 contracts, or any other number, we will discuss how you can adjust the Blueprint to fit your particular situation.

Special Note: Each Alert can be executed with a "Buy or Sell Stop" order. As a Concierge Client you will also have access to our Proprietary Software. For best results, as Price approaches the Entry Price or "Trigger", we recommend filtering the Entry. It is quite possible that in doing so, you will obtain a slightly better entry and in some cases our Software will advise you to either wait, or pass entirely on the Alert. The reason behind this, market conditions are constantly changing.

Our Software is very simple to use and we will spend 60 minutes with you initially, in a Private Online Meeting once your application is accepted and payment received. During this meeting you will be taught how to read the indications and we will answer any and all questions you have. As a Concierge Client, you will be assigned a Personal Analyst. Any time you have a question regarding an Alert, or a question in general, your Analyst is a phone call or text message away - 7 days a week. Of course you may email us at any time,24/7.

You will receive the Alerts for 5 trading days at no charge. You will receive as much private mentoring as you require. You will only be billed after the Free Trial if you do not cancel. At any time during the Free Trial you may Cancel at any time, no questions asked. We are standing by to help you in any way we can. If you wish to talk by telephone, please email the best day and time to reach you.

(Note: Annual Rate includes option to renew with no price increase in perpetuity)

To take a Free Trial of our Trade Alert Service, make your selection below:

Private Clients

We still have a limited number of Private Client openings. To inquire: dreeves@cfrn.net

December 19, 2014 at 8:04 PM

December 19, 2014 at 8:04 PM  emini,

emini,  live trading room,

live trading room,  trade alert service

trade alert service