S&P 500 | What Is it? How Do I Trade It?

June 1, 2013 at 11:25 PM

June 1, 2013 at 11:25 PM (QQQ)(DIA)(SPY)(GLD)(SLV)

S&P 500 | What Is It?

The S&P 500 created by Standard & Poor's in 1957 is not a stock, but instead a stock market index which groups together 500 publicly traded companies. The S&P 500 is considered to be both a bellwether for the U.S. economy and a benchmark for a vast number of index funds, exchange traded funds and mutual funds. Based on the newspaper or website you use, current price and performance can usually be found under one of the following symbols > ^GSPC, INX, and $SPX. Don't be confused by the different symbols as they all refer to the S&P 500 Cash Index.

The S&P 500 is a "Best of Breed" index. As the name suggests, the S&P 500 consists of 500 companies from a diverse range of industries. Contrary to a popular misconception, the S&P 500 is not a simple list of the largest 500 companies by market capitalization or by revenues. Rather, it is 500 of the most widely held U.S.-based common stocks, chosen by the S&P Index Committee for market size, liquidity, and sector representation.

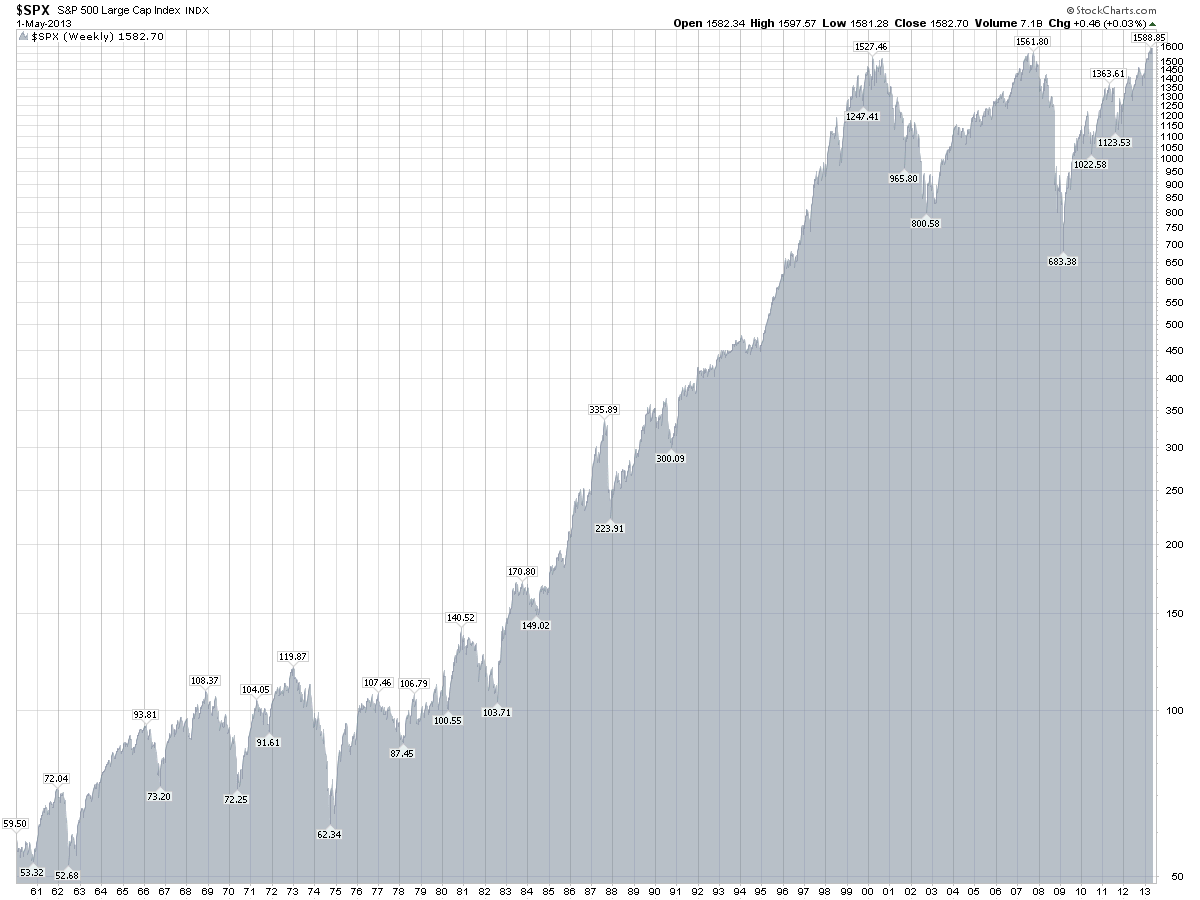

Unless the economy, or the world as we know it implodes, the index over time is going to rise. Period.

"Leading companies in leading industries" is the guiding principal for S&P 500 inclusion. A small number of international companies that are widely traded in the U.S. are included, but the Index Committee has announced that only U.S.-based companies will be added in the future. The S&P 500 is a "market-capitalization" weighted index. (Think of market cap as the price you would pay to buy all shares of a single company.)

The S&P 500 represents approximately 70% of the value of the U.S. equity market. The S&P 500 has significant liquidity requirements for its components, so some large, thinly traded companies are ineligible for inclusion. Because the index gives more weight to larger companies, it tends to reflect the price movement of a fairly small number of stocks. (Source: CFRN)

S&P 500 | Where Is It Traded?

(Source: Daniels Trading)

S&P 500 | How Do I Trade It?

Trading the S&P 500 no longer requires a trip to Chicago or a seat on the Chicago Mercantile Exchange (CME). Day Traders and Swing Traders around the world now trade the purely electronic version of the S&P 500 Index via Emini Futures as well as with Options and Exchange Traded Funds (ETF).

S&P Emini Futures were first introduced in 1997 by the CME. The value of the large S&P contract had simply become so large that many small traders were no longer able to participate. It turned out to be a brilliant idea and today stands as one of the most liquid and actively traded futures contracts in the world. The E-mini version is 1/5 the size of the large contract.

Average daily volume in the SP500 E-mini runs between 1.5 and 2.5 million contracts with an underlying value of $100 billion. Each E-mini contract represents the equivalent of roughly $81k in equity based on an index price of $1,627.00 . The formula is 50 X Current Price of the Index. What makes this market so unique is that for the purpose of emini futures trading and day trading, only $500 of margin is required to trade each contract. Also, unlike the stock market where you are required to maintain a minimum $25k account balance as an active day trader, the Pattern Day Trading Rule does not apply to emini futures trading.

S&P 500 Emini Futures - ESM3

S&P 500 Emini Futures - ESM3

Conclusion -

Liquid, accessible and affordable are all hallmarks of the S&P 500. In futures articles we will take a closer look at the wide variety of products from Options to Exchange Traded Funds that allow you to participate in one of the largest and most widely traded financial instruments available.

Questions?

Call us toll free @ 866-928-3310 during normal business hours.

After Dark - email support@cfrn.net or call 949-42-EMINI

5 DAY FREE TRIAL

CME,

CME,  S&P 500,

S&P 500,  day trading,

day trading,  emini futures trading

emini futures trading

Reader Comments (6)

is this what you trade in your trsading room? How much to learn?

Barb,

Are you referring to the S&P 500 Emini Futures? If so, then yes that is one of the markets we trade. We trade the 4 emini markets -- S&P / Dow / Nasdaq and Russell. We also trade other futures markets like Oil, Crude, Soybeans and more. Call or email for specific info.

Blessings

DeWayne

Is Daniels the broker you use or recommend?

Steve

The Esm 3 tweets you made tonight are they for this market? Are they for Monday? The market is closed on Sunay right? How do I make the trade?

Steve W,

Yes we recommend Daniels Trading 100%. The customer service provided by Burt and Leslie is second to none. Not only are they excellent brokers, they are also talented traders with many years of experience. If you are new to trading, Burt will even try to find time to hang out with you in the Live Trading Room and help you spot trade setups. When's the last time you saw a broker do that? Probably never.... Right?

We also code exclusively for the dtPro Platform. which is offered by Daniels at no charge to clients.

No platform fees - no data fees - very competitive commissions.

Blessings

DeWayne

Liz,

The symbol ESM3 is the S&P 500 Emini Futures June Contract. The Open Out-Cry Pit Session opens @ 8:30AM Central, but Globex opens @ 5PM Central Sunday afternoon. The tweets were real time for the Sunday night Globex session.

Blessings

DeWayne