Triple Top Threat Looms Large

April 22, 2013 at 2:34 PM

April 22, 2013 at 2:34 PM (QQQ)(DIA)(SPY)(GLD)(NFLX)

How To Trade Against A Triple Top Backdrop

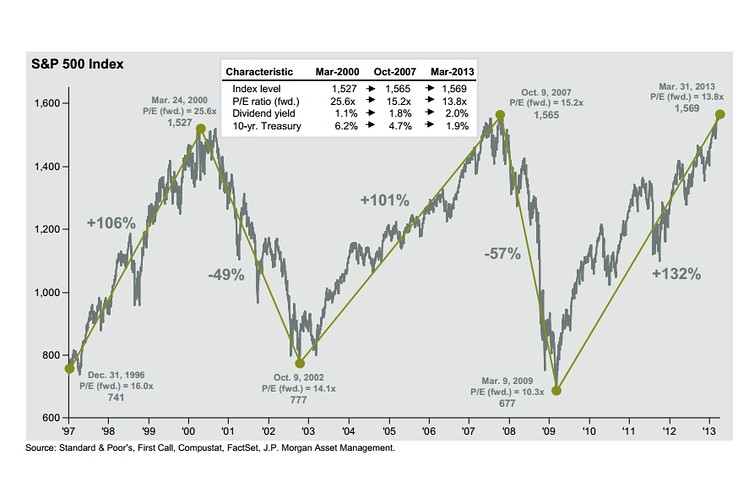

The Shadow knows... and that's exactly what we have in the S&P 500 Emini Futures - a gigantic shadow being cast over the markets by the biggest triple top in trading history. We are at all time historic highs in the Dow and the S&P over the past month and yet we can not seem to break out and break away. The longer we grind here without a meaningful break out, the greater the chance we will break down instead of up.

How do I trade against a triple top? Perhaps the easy answer becomes: You don't. With many markets to choose from, you might simply pick a different arena. Opportunities abound right now from Currencies, to Grains, to the Energy Complex. If the size of the account you're trading dictates the liquidity and participation level of the S&P, then keep all trades on a fairly short leash. There is nice volatility and healthy two sided action. As long as you can limit your exposure time wise, it would almost be a shame not to participate in these beautiful intraday swings.

Where do you see support? If we reference only the February lows, I would not want to see 1520 broken on a pull back. If we step back to gain a greater perspective and look to the lows of November 2012, as long as we don't break and close below 1415, the top may have another leg. Beyond the lows of November I say we have to embrace the possibility of a much deeper retracement and the possibility of a Bear Leg in a Bull Run.

Today's Trades

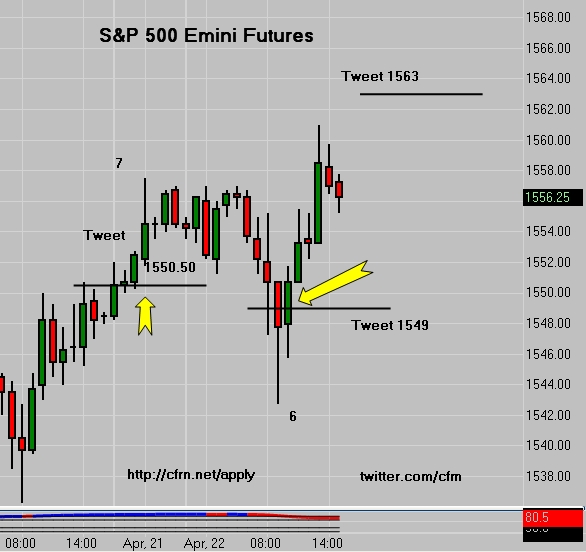

S&P 500 Emini Tweets & Trades

S&P 500 Emini Tweets & Trades

Today's Emini Radio Broadcast

CFRN - Voice of the Emini Futures

Questions?

Call us toll free @ 866-928-3310 during normal business hours.

After Dark - email support@cfrn.net or call 415-857-5654

Please leave a review on iTunes

5 DAY FREE TRIAL

emini futures,

emini futures,  live trading room,

live trading room,  triple top

triple top

Reader Comments