Weekly Zones Capture Another 20 Points

March 13, 2013 at 7:20 PM

March 13, 2013 at 7:20 PM (QQQ)(DIA)(SPY)(GLD)(BAC)

S&P 500 Makes Another 20 Points Available Between The Zones

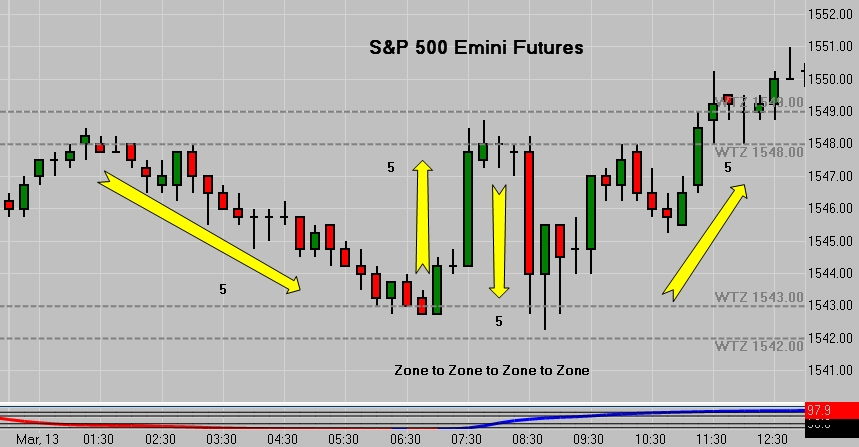

We covered the Weekly Trading Zones in depth in the last post. The market has now made an additional 20 points available as it continues to trade between the upper zone at 1548/1549 and the lower zone at 1542/1543. You will often hear traders complain about the market being "range bound". I won't make you suffer through the "lemons into lemonade" analogy, but that's really my point.

This particular range just so happens to be wide enough (5 Points), that it's possible to navigate and trade from the top to the bottom and back again. Once you're able to clearly define Support and Resistance, if there is enough distance between the two, you can trade it as long as you don't over think it. Bear in mind, if you're dealing with a 5 point range, any attempt to take more than 5 points on a trade, will leave you extremely disappointed.

S&P 500 Emini Futures - Zone to Zone - 15 Minute Chart

Realistic expectations are critical for success in trading. While you have no control over how far the market will travel on an any given move, you do have control over the number of contracts you trade. In other words, if you have a daily goal of earning $1,000 (just an example), and the current range is 5 points (just an example), forget nailing the top and the bottom. You want the market to first show you that the Support or Resistance Level is being respected. Confirmation costs money. In other words, if the range if 5 points, be content to scoop 2 or 3 points out of the middle. Since you have no hope of making the market move even 1 tick more... your leverage comes in trading additional contracts.

Increasing Contracts

Inevitably you will want to increase the number of contracts you trade if for no other reason, than the very good one I just gave you. Tread carefully. Yes you can make money twice as fast with double the contracts, you can also blow up your account twice as fast. There is only one logical way to increase the number of contracts you trade. One at a time.

Start with one. I don't care if your account balance is $5k or $50k, start with 1 contract. Only after you are consistently profitable in the Simulator will you move into live trading. Remember, this is not like trading stocks off a hot tip from your Barber's nephew. This is purely technical and the scissors are very sharp. No running! You need to make sure you know exactly what you're doing, or you'll end up wearing a very odd haircut for a long time to come. You can overcome a bad burrito in 24 hours, the psychological damage of a blown account can haunt you for a lifetime.

Once you are profitable in Sim, go live with 1. After you earn a minimum of $1,000, preferably $2,000, you can add an additional contract. You have now doubled your ability to earn money. You've also doubled how fast your account can evaporate. If the pressure of the second contract is too much, back down to one. Once you have earned an additional $1,000, preferably $2,000, add a third contract.

This may sound like a slow process, but it's designed to keep you solvent. By the time you hit 3 contracts, you only need 10-15 points to advance to 4. It starts to compound pretty quickly. Once you hit 5 it's time to consider peeling off some money for daily living expenses. Refer to your written business plan to determine exactly how much money you want Burt to wire you on a daily or weekly basis.

Dow Emini Live Trade

This video grows a bit long and grueling. Feel free to advance your way to the action points. There is a moral to this story. If you don't "get it" at the end of the video, email me - support@cfrn.net.

Questions?

Call us toll free @ 866-928-3310 during normal business hours.

After Dark - email support@cfrn.net or call 415-857-5654

Please leave a review on iTunes

5 DAY FREE TRIAL

Reader Comments