Recent Alerts - Current Margins - Contract Specifications

October 17, 2012 at 7:37 PM

October 17, 2012 at 7:37 PM (AAPL)(SPY)(GLD)(UA)(GOOG)

"Man looks in the abyss, there's nothing staring back at him. At that moment, man finds his character. And that is what keeps him out of the abyss." Lou Mannheim

Recent Trade Alerts - Contract Specifications And Margins

Emini S&P

Full Margin $3,850 / Day Margin $500

Consider being short ESZ2 below 1419.50 or long above 1437.00 #es #emini #futures #trading $ES_F

— DeWayne Reeves (@CFRN) October 14, 2012

Focused on 500 large-cap U.S. stocks, the S&P 500 is the second-most followed index for large-cap stocks after the Dow. The S&P 500 is considered by many to be the bellweather in regards to both short and longer term trends. The S&P 500 is the most heavily traded futures contract at the CME - Chicago Mercantile Exchange. Average daily volume ranges from 1-3 million contracts.

| E-mini S&P 500 Futures | |||||

|---|---|---|---|---|---|

| Opening Date | 9/9/1997 | ||||

| Ticker Symbol | ES ES= Clearing View product and vendor codes |

||||

| Contract Size | $50 x E-mini S&P 500 futures price | ||||

| Tick Size (minimum fluctuation) | OUTRIGHT | 0.25 index points=$12.50 | |||

| CALENDAR SPREAD | 0.05 index points=$2.50 | ||||

| Trading Hours All time listed are Central Time |

CME Globex (ETH) |

MON-THURS: 5:00 p.m.-3:15 p.m. & 3:30 p.m.-4:30 p.m. (Daily maintenance shutdown 4:30 p.m.-5:00 p.m.) SUN: 5:00 p.m.-3:15 p.m. |

|||

| Contract Months | Five months in the March Quarterly Cycle (Mar, Jun, Sep, Dec) | ||||

| Last Trade Date/Time View Calendar |

CME Globex |

Trading can occur up to 8:30 a.m. on the 3rd Friday of the contract month

|

|||

| Settlement Procedure | Daily E-mini S&P 500 Settlement Procedure (PDF) Final E-mini S&P 500 Settlement Procedure (PDF) |

||||

| Daily Price Limits | RTH: Successive 10%, 20%, 30% limits (downside only) ETH (overnight): 5% up or down View price limits details. |

||||

| Position Limits | Work in conjunction with existing S&P 500 position limits | ||||

| Block Trade Eligibility | No. View more on block-trade eligible contracts. | ||||

| Block Minimum | N/A | ||||

| Rulebook Chapter | 358 | ||||

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CME. | ||||

Source: CME Group

Gold Futures

Full Margin $9,112 / Day Margin $4,556

Consider being short December Gold below 1735 or long above 1767 whichever presents first. Stay tuned... #gold #gld #futures #trading $GCC_F

— DeWayne Reeves (@CFRN) October 14, 2012

(GGC) Gold

(GGC) Gold

Gold futures are hedging tools for commercial producers and users of gold. They also provide global price discovery and opportunities for portfolio diversification.

Learn More...

| Gold Futures | |||||

|---|---|---|---|---|---|

| Product Symbol | GC | ||||

| Venue | CME Globex, CME ClearPort, Open Outcry (New York) | ||||

| Hours (All Times are New York Time/ET) |

CME Globex: | Sunday – Friday 6:00 p.m. – 5:15 p.m. (5:00 p.m. – 4:15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) | |||

| CME ClearPort: | Sunday – Friday 6:00 p.m. – 5:15 p.m. (5:00 p.m. – 4:15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) | ||||

| Open Outcry: | Monday – Friday 8:20 a.m. - 1:30 p.m. (7:20 a.m. - 12:30 p.m. CT) | ||||

| Contract Size | 100 troy ounces | ||||

| Price Quotation | U.S. Dollars and Cents per troy ounce | ||||

| Minimum Fluctuation | $0.10 per troy ounce | ||||

| Termination of Trading | Trading terminates on the third last business day of the delivery month. | ||||

| Listed Contracts | Trading is conducted for delivery during the current calendar month; the next two calendar months; any February, April, August, and October falling within a 23-month period; and any June and December falling within a 72-month period beginning with the current month. | ||||

| Settlement Type | Physical | ||||

| Settlement Procedure | Daily Gold Settlement Procedure (PDF) Final Gold Settlement Procedure (PDF) |

||||

| Delivery Period | Delivery may take place on any business day beginning on the first business day of the delivery month or any subsequent business day of the delivery month, but not later than the last business day of the current delivery month. | ||||

| Trading at Settlement (TAS) | Trading at Settlement is allowed in the active contract month. The active contract months will be February, April, June, August and December. On any given date, TAS transactions will be allowed only in a single contract month. TAS transactions may be executed at the current day’s settlement price or at any valid price increment ten ticks higher or lower than the settlement price. | ||||

| Grade and Quality Specifications | Gold delivered under this contract shall assay to a minimum of 995 fineness. | ||||

| Position Limits | NYMEX Position Limits | ||||

| Rulebook Chapter | 113 | ||||

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of COMEX. | ||||

Source: CME Group

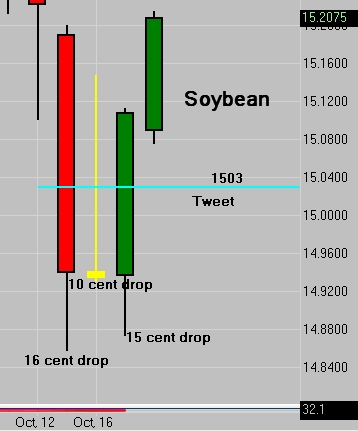

Soybean Futures

Full Margin $5,062 / Day Margin $2,531

Consider being short ZSX2 below 15.03. #soybeans $SZ_F #grains

— DeWayne Reeves (@CFRN) October 14, 2012

(ZS) Soybeans

(ZS) Soybeans

| Soybean Futures | |||||

|---|---|---|---|---|---|

| Contract Size | 5,000 bushels (~136 metric tons) | ||||

| Deliverable Grade | #2 Yellow at contract price, #1 Yellow at a 6 cent/bushel premium, #3 Yellow at a 6 cent/bushel discount | ||||

| Pricing Unit | Cents per bushel | ||||

| Tick Size (minimum fluctuation) | 1/4 of one cent per bushel ($12.50 per contract) | ||||

| Contract Months/Symbols | January (F), March (H), May (K), July (N), August (Q), September (U) & November (X) | ||||

| Trading Hours | CME Globex (Electronic Platform) |

5:00 pm - 2:00 pm, Sunday - Friday Central Time

|

|||

| Open Outcry (Trading Floor) |

9:30 am* - 2:00 pm Monday - Friday Central Time

*opens at 7:20 a.m. CT for major USDA crop reports |

||||

| Daily Price Limit | $0.70 per bushel expandable to $1.05 and then to $1.60 when the market closes at limit bid or limit offer. There shall be no price limits on the current month contract on or after the second business day preceding the first day of the delivery month. | ||||

| Settlement Procedure | Daily Grains Settlement Procedure (PDF) Final Soybean Settlement Procedure (PDF) |

||||

| Last Trade Date | The business day prior to the 15th calendar day of the contract month. | ||||

| Last Delivery Date | Second business day following the last trading day of the delivery month. | ||||

| Product Ticker Symbols | CME Globex (Electronic Platform) | ZS S=Clearing |

|||

| Open Outcry (Trading Floor) | S | ||||

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CBOT. | ||||

Source: CME Group

Crude Oil

Light Sweet Crude Oil (Physical) futures are an outright crude oil contract between a buyer and seller. The contracts also serve as a key international pricing benchmark.

Full Margin $5,610 / Day Margin $2,805

Consider being short November Crude GCLX2 below 90.90 or long above 92.72 whichever presents first. #crude #futures #trading $GCL_F #gclx2

— DeWayne Reeves (@CFRN) October 14, 2012

(CL) Crude

(CL) Crude

| Light Sweet Crude Oil Futures | |||||

|---|---|---|---|---|---|

| Product Symbol | CL | ||||

| Venue | CME Globex, CME ClearPort, Open Outcry (New York) | ||||

| Hours (All Times are New York Time/ET) |

CME Globex | Sunday - Friday 6:00 p.m. - 5:15 p.m. New York time/ET (5:00 p.m. - 4:15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) | |||

| CME ClearPort | Sunday – Friday 6:00 p.m. – 5:15 p.m. (5:00 p.m. – 4:15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) | ||||

| Open Outcry | Monday – Friday 9:00 AM to 2:30 PM (8:00 AM to 1:30 PM CT) | ||||

| Contract Unit | 1,000 barrels | ||||

| Price Quotation | U.S. Dollars and Cents per barrel | ||||

| Minimum Fluctuation | $0.01per barrel | ||||

| Maximum Daily Price Fluctuation | Initial Price Fluctuation Limits for All Contract Months. At the commencement of each trading day, there shall be price fluctuation limits in effect for each contract month of this futures contract of $10.00 per barrel above or below the previous day's settlement price for such contract month. If a market for any of the first three (3) contract months is bid or offered at the upper or lower price fluctuation limit, as applicable, on Globex it will be considered a Triggering Event which will halt trading for a five (5) minute period in all contract months of the CL futures contract, as well as all contract months in all products cited in the Associated Products Appendix of rule 200.06. Trading in any option related to this contract or in an option contract related to any products cited in the Associated Products Appendix which may be available for trading on either Globex or on the Trading Floor shall additionally be subject to a coordinated trading halt. | ||||

| Termination of Trading | Trading in the current delivery month shall cease on the third business day prior to the twenty-fifth calendar day of the month preceding the delivery month. If the twenty-fifth calendar day of the month is a non-business day, trading shall cease on the third business day prior to the last business day preceding the twenty-fifth calendar day. In the event that the official Exchange holiday schedule changes subsequent to the listing of a Crude Oil futures, the originally listed expiration date shall remain in effect. In the event that the originally listed expiration day is declared a holiday, expiration will move to the business day immediately prior. | ||||

| Listed Contracts | Crude oil futures are listed nine years forward using the following listing schedule: consecutive months are listed for the current year and the next five years; in addition, the June and December contract months are listed beyond the sixth year. Additional months will be added on an annual basis after the December contract expires, so that an additional June and December contract would be added nine years forward, and the consecutive months in the sixth calendar year will be filled in. Additionally, trading can be executed at an average differential to the previous day's settlement prices for periods of two to 30 consecutive months in a single transaction. These calendar strips are executed during open outcry trading hours. |

||||

| Settlement Type | Physical | ||||

| Settlement Procedure | Daily NYMEX Energy Futures Settlement Procedure (PDF) Final NYMEX Energy Futures Settlement Procedure (PDF) |

||||

| Trading at Settlement (TAS) | Trading at settlement is available for spot (except on the last trading day), 2nd, 3rd and 7th months and subject to the existing TAS rules. Trading in all TAS products will cease daily at 2:30 PM Eastern Time. The TAS products will trade off of a "Base Price" of 0 to create a differential (plus or minus 10 ticks) versus settlement in the underlying product on a 1 to 1 basis. A trade done at the Base Price of 0 will correspond to a "traditional" TAS trade which will clear exactly at the final settlement price of the day. | ||||

| Trade at Marker (TAM) | TAM trading is analogous to our existing Trading at Settlement (TAS) trading wherein parties will be permitted to trade at a differential that represents a not-yet-known price. TAM trading will use a marker price, whereas TAS trading uses the Exchange-determined settlement price for the applicable contract month. As with TAS trading, parties will be able to enter TAM orders at the TAM price or at a differential between one and ten ticks higher or lower than the TAM price. Trading at marker is available for spot month on the last trading day. Light Sweet Crude Oil (CL) spot, 2nd and 3rd months and nearby/second month, second/third month and nearby/third month calendar spreads No-Activity Periods: 4:30 p.m. London time - 5:50 p.m. Eastern time Monday - Thursday 4:30 p.m. London time Friday - 5:20 p.m. Eastern time Sunday |

||||

|

Delivery |

(A) Delivery shall be made F.O.B. at any pipeline or storage facility in Cushing, Oklahoma with pipeline access to TEPPCO, Cushing storage or Equilon Pipeline Company LLC Cushing storage. Delivery shall be made in accordance with all applicable Federal executive orders and all applicable Federal, State and local laws and regulations. For the purposes of this Rule, the term F.O.B. shall mean a delivery in which the seller:

© All deliveries made in accordance with these rules shall be final and there shall be no appeal.

|

||||

| Delivery Period | (A) Delivery shall take place no earlier than the first calendar day of the delivery month and no later than the last calendar day of the delivery month. (B) It is the short's obligation to ensure that its crude oil receipts, including each specific foreign crude oil stream, if applicable, are available to begin flowing ratably in Cushing, Oklahoma by the first day of the delivery month, in accord with generally accepted pipeline scheduling practices. © Transfer of title-The seller shall give the buyer pipeline ticket, any other quantitative certificates and all appropriate documents upon receipt of payment. The seller shall provide preliminary confirmation of title transfer at the time of delivery by telex or other appropriate form of documentation. |

||||

| Grade and Quality Specifications | Please see rulebook chapter 200 | ||||

| Position Limits | NYMEX Position Limits | ||||

| Rulebook Chapter | 200 | ||||

|

Exchange Rule |

These contracts are listed with, and subject to, the rules and regulations of NYMEX. |

||||

Source: CME Group

Euro Currency Futures

Full Margin $3,300 / Day Margin $825

Consider being long the December Euro above 1.3005 or short below 1.2885 whichever present first. #euro #futures #trading $6E_F $ES_F #6ez2

— DeWayne Reeves (@CFRN) October 14, 2012

(6E) Euro

(6E) Euro

| EUR/USD Futures | |||||

|---|---|---|---|---|---|

| Contract Size | 125,000 euro | ||||

| Contract Month Listings | Six months in the March quarterly cycle (Mar, Jun, Sep, Dec) | ||||

| Settlement Procedure | Physical Delivery Daily FX Settlement Procedures (PDF) Final FX Settlement Procedures (PDF) |

||||

| Position Accountability | 10,000 contracts | ||||

| Ticker Symbol | CME Globex Electronic Markets: 6E Open Outcry (All-or-None only): EC AON Code: UG View product and vendor codes |

||||

| Minimum Price Increment | $.0001 per euro increments ($12.50/contract). $.00005 per euro increments ($6.25/contract) for EUR/USD futures intra-currency spreads executed on the trading floor and electronically, and for AON transactions. | ||||

| Trading Hours | OPEN OUTCRY (RTH) | 7:20 a.m.-2:00 p.m. | |||

| GLOBEX (ETH) | Sundays: 5:00 p.m. – 4:00 p.m. Central Time (CT) next day. Monday – Friday: 5:00 p.m. – 4:00 p.m. CT the next day, except on Friday - closes at 4:00 p.m. and reopens Sunday at 5:00 p.m. CT. | ||||

| CME ClearPort | Sunday – Friday 6:00 p.m. – 5:15 p.m. (5:00 p.m. – 4:15 p.m. Chicago Time/CT) with a 45–minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) | ||||

| Last Trade Date / Time View calendar |

9:16 a.m. Central Time (CT) on the second business day immediately preceding the third Wednesday of the contract month (usually Monday). | ||||

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CME. | ||||

| Block Trade Eligibility | Yes. View more on Block Trade eligible contracts. | ||||

| Block Trade Minimum | 150 Contracts | ||||

| EFP Eligibility | Yes. View more on EFPs. | ||||

Source: CME Group

Nasdaq-100

Full Margin $2,200 / Day Margin $500

Consider being short NQZ2 below 2690 or long above 2735 whichever presents first. #NQ #nasdaq $NQ_F #emini #futures #trading

— DeWayne Reeves (@CFRN) October 14, 2012

(NQ) Nasdaq

(NQ) Nasdaq

| E-mini NASDAQ 100 Futures | |||||

|---|---|---|---|---|---|

| Opening Date | 6/21/1999 | ||||

| Ticker Symbol | NQ NQ= Clearing View product and vendor codes |

||||

| Contract Size | $20 x E-mini NASDAQ-100 futures price | ||||

| Tick Size (minimum fluctuation) | OUTRIGHT |

0.25 index points=$5.00

|

|||

| CALENDAR SPREAD |

0.05 index points=$1.00

|

||||

| Trading Hours All time listed are Central Time |

CME Globex (ETH) |

MON-THURS: 5:00 p.m.-3:15 p.m. & 3:30 p.m.-4:30 p.m. (Daily maintenance shutdown 4:30 p.m.-5:00 p.m.) SUN: 5:00 p.m.-3:15 p.m. |

|||

| Contract Months | Five months in the March Quarterly Cycle (Mar, Jun, Sep, Dec) | ||||

| Last Trade Date/Time View Calendar |

CME Globex |

Trading can occur up to 8:30 a.m. on the 3rd Friday of the contract month. | |||

| Settlement Procedure | Daily E-mini NASDAQ Settlement Procedure (PDF) Final E-mini NASDAQ Settlement Procedure (PDF) |

||||

| Daily Price Limits | RTH: Successive 10%, 20%, 30% limits (downside only) ETH (overnight): 5% up or down View price limits details |

||||

| Position Limits | Work in conjunction with existing NASDAQ-100 futures and options position limits. | ||||

| Block Trade Eligibility | No. | ||||

| Block Minimum | N/A | ||||

| Rulebook Chapter | 359 | ||||

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CME. | ||||

Source: CME Group

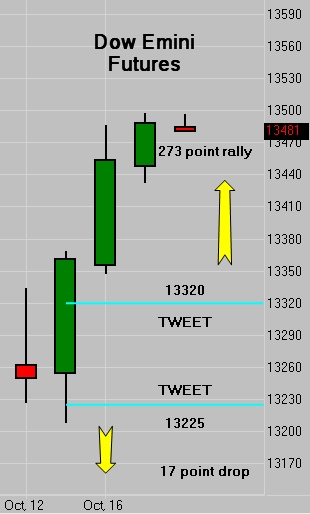

Emini Dow

Full Margin $2,750 / Day Margin $500

Consider being short YMZ2 below 13225 or long above 13320 whichever presents first. $YM_F #dow #ym #emini #futures #trading

— DeWayne Reeves (@CFRN) October 14, 2012

(YM) Dow

(YM) Dow

|

E-mini Dow ($5) Futures |

|||||

|---|---|---|---|---|---|

| Opening Date | 4/5/2002 | ||||

| Ticker Symbol | YM YM= Clearing View product and vendor codes |

||||

| Contract Size | $5 x E-mini Dow ($5) futures price | ||||

| Tick Size (minimum fluctuation) | 1.00 index points=$5.00 | ||||

| Trading Hours All time listed are Central Time |

CME Globex (ETH) |

MON-THURS: 5:00 p.m.-3:15 p.m. & 3:30 p.m.-4:30 p.m. (Daily maintenance shutdown 4:30 p.m.-5:00 p.m.) SUN: 5:00 p.m.-3:15 p.m. |

|||

| Contract Months | Four months in the March Quarterly Cycle (Mar, Jun, Sep, Dec) | ||||

| Last Trade Date/Time View Calendar |

CME Globex |

Trading can occur up to 8:30 a.m. on the 3rd Friday of the contract month | |||

| Final Settlement Procedure | Cash Settlement. All open positions at close of last day of trading are settled in cash to the Special Opening Quotation (SOQ) on Friday a.m. of the Dow Jones Industrial Average Index. See SOQ FAQ. | ||||

| Settlement Procedure | Daily E-mini Dow Settlement Procedures (PDF) | ||||

| Daily Price Limits | RTH: Successive 10%, 20%, 30% limits (downside only) ETH (overnight): 5% up or down View price limits details |

||||

| Position Limits | The aggregate position limit in BIG Dow ($25) futures, E-mini Dow ($5) futures and options, and DJIA ($10) futures and options is 50,000 DJIA ($10) futures-equivalent contracts, net long or short in all contract months combined | ||||

| Block Trade Eligibility | No. View more on block-trade eligible contracts. | ||||

| Block Minimum | N/A | ||||

| Rulebook Chapter | 27 | ||||

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CBOT. | ||||

Source: CME Group

As opportunities unfold we will keep you posted.

Questions?

Call us toll free @ 866-928-3310 during normal business hours.

After Dark - email support@cfrn.net or call 415-857-5654

Please leave a review on iTunes

5 DAY FREE TRIAL

contract specifications,

contract specifications,  emini futures,

emini futures,  margins

margins

Reader Comments