Emini FuturesCast / The Daily Pod 05/23/11

May 23, 2011 at 3:05 PM

May 23, 2011 at 3:05 PM (QQQQ)(DIA)(SPY)(GLD)(SLV)

Of course we chatted about Mister Camping but then got straight to the markets and only dabbled in political rhetoric right at the end. All in all..... Not bad for a slow Monday.

E-Mini S&P 500: Euro Zone fears put bears in control!

Between the lackluster global recovery and the Euro Zone fears, the E-Mini S&P 500 sank while investors scurried to safe-haven products such as the US Treasuries, the US Dollar and Gold. Copper is a market directly tied to industrial growth and China imports dropped 16.6 in April, down 7.2 one year ago. China factory’s have slowed production. Manufacturers in China and Europe have slackened as the inflationary concerns have trumped production demand and supply. The Crude Oil will also be sensitive to the slowed production in terms of demand. The inventory data to be released Wednesday, may reflect some build and the decreased demand may in fact cause a slide in the energies. Contagion concerns again mount to pressure the Euro FX. Ratings on Greece and Italy have weighed on the market, while elections in Spain do not point to stability. Italy was cut from stable to negative and the imbalance was regarded significant as the IMF and the EU have not addressed any potential bailouts. The austerity programs initiated to contain the further potential debt woes of each country had not been met by friendly patrons. Rebellion and riots often follow any measures taken to curtail the debt through tightening. The stronger US Dollar weighed on the E-Mini S&P 500 as the bears took control today. The channel remains in a downtrend. There is little to drive this market as most of the earnings have been released. Mergers/ acquisitions and fund interest may be able to provide support. Technically, after harsh dips, we do look for a potential bounce. We do believe that the market overextends and then needs to correct itself.

Tuesday, we look forward to New Home Sales at 9:00 AM CST.

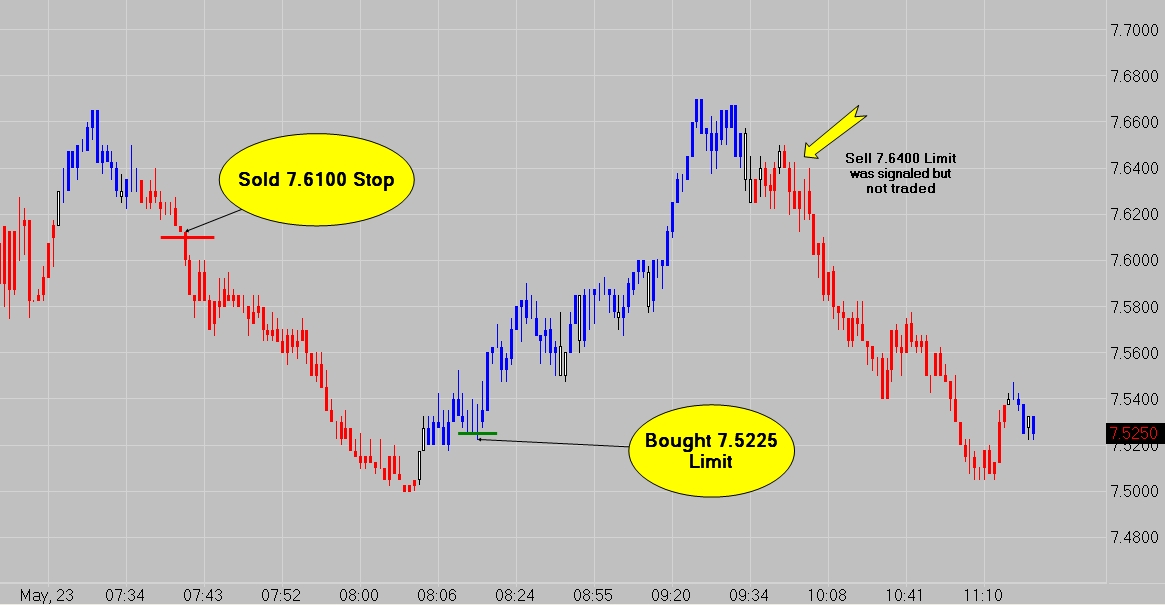

Today we traded Corn for the first time in the Live Trading Room. How did we do? Have a look...

If you want to see the same chart WITH the indicators, Drop On By tomorrow.

Tuesday, what to expect! We are technically still in sell mode on the Daily Chart! Tuesday, we look for an outside day! Today’s range was $1327.00 - $1310.00. The market settled at $1315.25. Our comfort zone or point of control for this market appears to be $1317.50. Our anticipated potential range for Tuesday’s trading could be $1330.50 - $1305.50. The market stays bearish below $1357.50.

Leslie Burton

Senior Market Strategist

Are you looking for a better way?

We have one.

Trading's not easy, but it can be simple.

Reader Comments