Emini Futures Trading / Market Stages 2 Day Rally

April 15, 2011 at 10:21 PM

April 15, 2011 at 10:21 PM E-Mini S&P 500: Were you buying after yesterday’s close?

Despite sluggish earnings from Google, the markets finished higher across the board today! The economic data this morning lite the fire under the bulls. Consumer Sentiment came in better than expected. CPI -- excluding food and energy – was up 0.1 percent after increasing 0.2 percent the prior month, and below analysts' expectations for a 0.2 percent rise. Inflation-adjusted earnings for all private workers fell 0.5% in March, the worst monthly drop since July 2008, according to Labor Department data. Nominal wages were flat while consumer prices climbed more than 0.5% for a second straight month. The consumer prices may have risen due to the higher food and energy costs. Industrial Production was up 0.8 percent. The day had a bullish tone after going through a temporary down-trend earlier in the week. Earlier in the week, Goldman Sachs had announced to their clients that they should liquidate their commodity positions. The market had a temporary retracement along with the other tangible commodities across the board. The next bit of news was that a Senate Investigation was being held to review the Goldman Sachs practices in dealing with their clients.

Monday, we have no major US Economic Reports scheduled.

BETWEEN the LINES

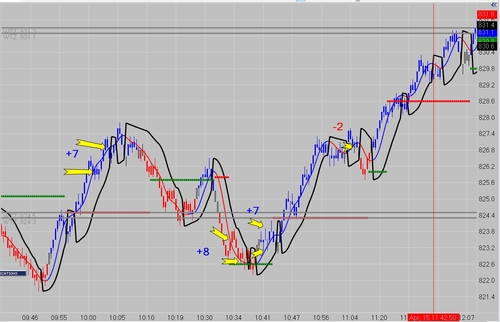

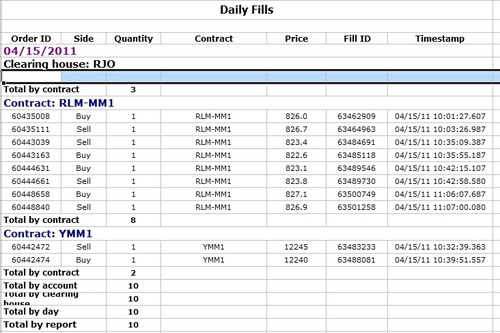

We've always said our Indicator Set worked well across multiple markets and time frames, but I don't believe I've ever shared a chart of the Russell. Michael has been trading the TF of late in the Live Trading Room and here's a glimpse at how those trades went this morning.

Monday, what to expect!We are technically still in fifth day sell mode on the Daily Chart. The E-Mini S&P 500 has come up today to restore confidence in the market. If Monday shows us the market maintaining levels above $1300.00, we may see a trend change. Monday, we look for an inside to higher day!

Today’s range was $1319.25 - $1305.75. The market settled at $1318.75. Our comfort zone or point of control for this market appears to be $1313.00. Our anticipated potential range for Monday’s trading may be $1323.75 - $1305.50. The market stays bearish below $1332.50.

Best regards,

Leslie Burton

Reader Comments