Emini Podcast | Gap And Stall | Episode #1,560

December 17, 2012 at 5:47 PM

December 17, 2012 at 5:47 PM (QQQ)(FB)(AAPL)(SPY)(SODA)

S&P 500 Emini Futures

Friday was a trend down day, but things firmed up at the end and the close was quite bullish. On an hourly chart you will notice that the final candle on Friday had no wick on the top. This tells us the last orders to cross the desk were buyers looking to get long before the weekend, and/or traders exiting short positions. Remember, it takes two to tango. It takes both a buyer and a seller to create a transaction.

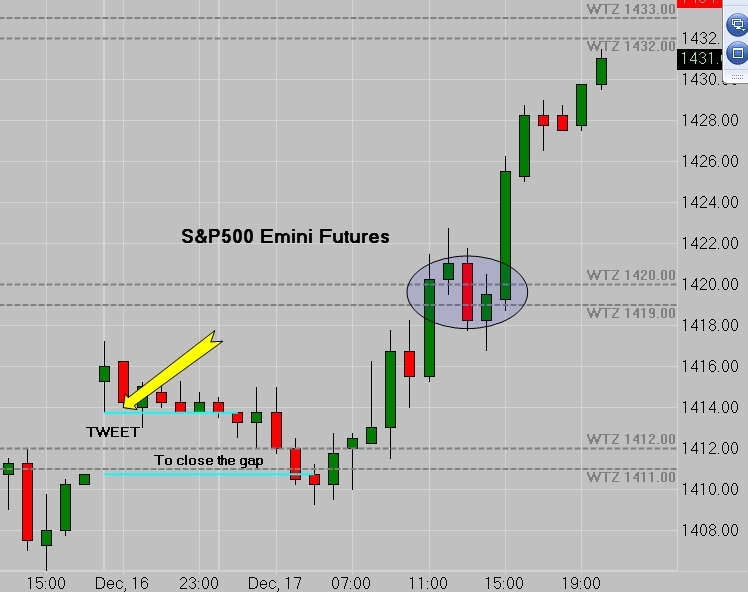

True to form the market did gap higher on the Globex open Sunday night and promptly stalled. Based on the "Gap and Stall", we issued the following Tweet -

ESH3 gapped higher on Globex based on bullish close Friday. Consider being short below 1414 down to possibly close gap. SES $ES_F #es

— DeWayne Reeves (@CFRN) December 16, 2012

(ES) S&P 500 Emini Futures - "Gap & Stall" Pattern

(ES) S&P 500 Emini Futures - "Gap & Stall" Pattern

Friday's close was 1410.75 which made the trade worth 3.25 points. Once the gap was filled our Weekly Trading Zone kicked into gear and the market began it's climb to the first rung on the ladder - 1419/1420. After 4 hours of consolidation at the Zone, we caught a nice bid going into the close and here we sit on the Globex session, perched at the next WTZ - 1432/1433.

I went deep Friday night explaining how this process works. I won't burden you by explaining it all over again. As they say... "A picture is worth a thousand words", or in this case - just 20 points.

Apple Inc. (AAPL)

Sunday Night's Tweet -

Technically speaking, Apple Inc. (AAPL) is deep in the throes of a Death Cross. We are also approaching a... read.bi/YaDpSg

— DeWayne Reeves (@CFRN) December 17, 2012

Technically speaking, Apple Inc. (AAPL) is deep in the throes of a Death Cross. We are also approaching a double bottom on the daily chart. Keep in mind, analysts have a keen knack for downgrading stocks at the bottom and upgrading near the top. As for the Death Cross business, it sounds far more ominous than it actually is. In plain english it simply means the 50 Day Simple Moving Average has crossed below the 200 Day SMA. It appears most of the damage has already been done. The last time Apple was available at such a deeply discounted price, investors and traders pounced, running it up $90+ in relatively short order.

TRADE IDEA: Consider being long Apple (AAPL) as price crosses above Friday's opening price of $514.75 with an initial target of $575.00 and/or the 50 Day SMA whichever presents first. If sales figures out of China this weekend are accurate, this will have a dramatic effect on Q4 results with almost 2 weeks left in the year. Also the deeply discounted prices for the iPhone 5 are creating long lines at Walmart and the discounted pricing whacks Walmart's margins, not Apple. Note: If currently short AAPL consider exiting your position on a daily close above $514.75.

(Disclosure: I do not currently own shares of AAPL or WMT nor will I be initiating a position within the next 30 days.)

As opportunities unfold we'll keep you posted.

Questions?

Call us toll free @ 866-928-3310 during normal business hours.

After Dark - email support@cfrn.net or call 415-857-5654

Please leave a review on iTunes

5 DAY FREE TRIAL

emini futures,

emini futures,  gap strategy,

gap strategy,  trading the gap

trading the gap

Reader Comments