SP500 Emini Swing Trade Update

November 25, 2012 at 11:43 PM

November 25, 2012 at 11:43 PM (GRPN)(FB)(QQQ)(SPY)(TSLA)

Final Update For Last Weeks S&P 500 Swing Trade

by DeWayne Reeves

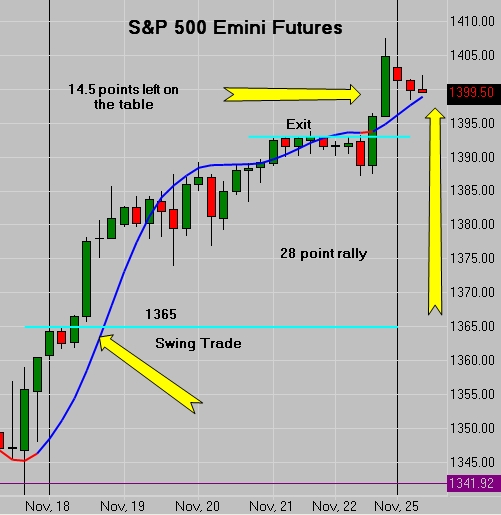

Our last Swing Trade ended on a bitter-sweet note. I gave our CFRN Partners some very sound reasoning to take off any remaining contracts at 1393.

Here is exactly what I told them -

_____________________________________________________________________

In our last update we said

"The next Weekly Trading Zone overhead is 1397/1398. If you do plan to leave part of your position on, I suggest you consider taking some or all of it off, before the Zone. 1392/1393 might sound overly cautious. Does it? Good!"

Tonight during quiet trading in the Asian session, we reached 1393. From the original entry at 1365 that's a distance of 28 points. Could the market trade higher? It very well could, but I'm going to encourage you to take any remaining open profits you have in this trade and go see the cashier. In doing so, you will have had an excellent holiday trading week and like Seinfeld, you go out on top. Go relax and spend some true quality time with your family this holiday.

Before I go, I want to share my new Daddy trick with you. Around my house things can get pretty hectic. Between school, karate lessons, saxophone practice, trading, cars that break down, pipes that leak, and a multitude of other things life throws at us, sometimes this Daddy gets a little overwhelmed. He can bark, let his temper flare, rush to judge, and then swim in his own regret. Today was one of those days. All the things I just mentioned were in full play plus I was knee-deep in pulling off the big event down at the Church to feed the homeless.

In my well intentioned attempt to make sure the disenfranchised had a night to remember, I was on the verge of giving my kids a night they could never forget. And then I remembered my secret weapon. I keep it on my iPhone. I grabbed the kids as my wife was getting dressed and pulled them both onto my lap right there at the foot of the stairs, opened the secret weapon and hit play. Go ahead -

Click it!

Daddy got his mind right. Just that quick.

My little girl looked up and said "Why are you crying Daddy?"

I said "Don't worry baby, Daddy's got an App for that too."

And we laughed, and it was good, and God was on the throne and Daddy was sitting there on the floor with his arms and heart as full as they could ever be.

I want that for you my friend. You may not have little ones at home anymore, but you've got someone, somewhere, and time is moving quickly. So today, let's just slow it all way down. Let's make time to be in the moment. The bills, the problems, the doctor, the boss, the neighbor, they'll all be there come Monday. I promise...

Happy Thanksgiving!

(make the most of it cause - "you're gonna miss this")

______________________________________________________________________

I'm well aware that my overly cautious nature may have cost the Partners a few dollars. OK, more than a few. Fair enough. If you followed my advice and took off the balance of your position at 1393, you missed the post Thanksgiving push to 1407.50. I'm not here to apologize, as I still believe my reasoning was sound. Go back and read the last email if you missed it. Did the market continue up an additional 14.5 points? Yes it did. Did our original entry on the Swing Trade give us a good entry at 1365? It did, to the tune of 28 points up to 1393.

(ES) S&P500 Emini Futures SWing Trade

(ES) S&P500 Emini Futures SWing Trade

We had a 28 point move followed by 14.5 point rapid advance. Often the final part of a move will be the most aggressive. Is the move finished?

We gapped lower on the Globex open in quiet trade and have drifted slightly lower so far. Anything is possible, so let's be prepared.

Partners, you've already been updated via the medium of your choice,

Twitter - Email - Smart Phone

If you're not a Partner, Take Our FREE TRIAL and put the power of CFRN to work for you.

As opportunities unfold we will keep you posted.

Questions?

Call us toll free @ 866-928-3310 during normal business hours.

After Dark - email support@cfrn.net or call 415-857-5654

Please leave a review on iTunes

5 DAY FREE TRIAL

emini indicators,

emini indicators,  emini swing trading

emini swing trading

Reader Comments