Emini Futures Trading / Ding Dong Bin Laden Is Dead

May 2, 2011 at 5:09 PM

May 2, 2011 at 5:09 PM Or Is He?

S&P 500 Emini: The E-Mini S&P 500 had a spike last evening on the news of a dispatched leading terrorist “Osama Bin Laden” by US Forces, who has been known for such attacks as 911. The market took the news as a positive for the US Government. President Barrack Obama had a boost for his next political campaign. Some Americans may be skeptical as no US Government pictures, videos or body have been released. It was said that the body of the deceased had been buried at sea. It is the demise of one terrorist that created our rally last evening and even as it was short-lived, one terrorist at a time may still help investor sentiment. President Obama may re-structure the US involvement within the Middle East with this last deployment. It is likely that we will be seeking to unite all people in peace to combat any adverse thoughts toward this military action. It is May and we did not go away! It will be crucial to see some positive economic reports this week. US ISM Index was 60.4 in April verses the 61.2 in March. Construction Spending was up 1.4 % to an annual rate of $768.9 billion. It has been feared that the high prices of Crude Oil and other products may in fact keep spending down. We look to monitor the inflation during these times as often it will lead to hindered profits for companies.

Tuesday, we look forward to Factory Orders at 9:00 AM CST.

BETWEEN the LINES

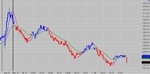

Can you spot the 7 reversals on this chart? What if I told you 6 of those were Weekly Trading Zones? Would you believe me? You don't have to... Take the FREE TRIAL and see for yourself.

Tuesday, what to expect! We are technically in buy mode on the Daily Chart. Tuesday, we look for an inside to lower day! Our “Bearish Sentiment Indicator” will have us look to sell this market at $1367.00 - $1364.00. Today’s range was $1373.50 - $1354.75. The market settled at $1357.75. Our comfort zone or point of control for this market appears to be $1362.75. Our anticipated potential range for Tuesday’s trading may be $1370.00 - $1352.50. The market stays bullish above $1352.50.

Leslie Burton

Senior Market Strategist

learn to trade emini,

learn to trade emini,  sp emini

sp emini

Reader Comments