Fair Value | Can The S&P Futures Break the 1500 Barrier?

January 27, 2013 at 11:30 PM

January 27, 2013 at 11:30 PM 5 Year High Lands Inside Our Highest Weekly Trading Zone

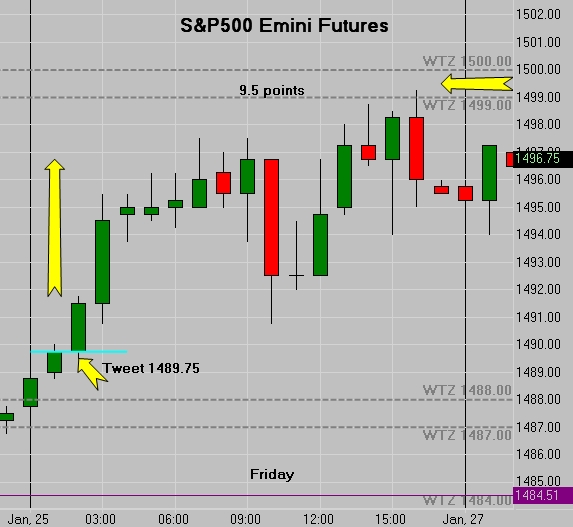

The high of the the day, high of the week and the high of the last 5 years, landed inside our Highest Weekly Trading Zone @ 1499.25. The Zone was 1499/1500. If you are a new Partner, your Weekly Zones for the coming week and your access link for the Live Trading Room will arrive via email @ 6:15AM EST.

Here's a look at the high on Friday -

(ES) S&P500 Emini Futures 5 Year High

(ES) S&P500 Emini Futures 5 Year High

Fair Value - S&P500 Cash Market Vs. Emini Futures

D,

The difference between that cash and futures is called the "premium" and is what the buy and sell programs are triggered from, arbitrage when it's above or below "fair value". Two different things, hard to explain without long long explanation and some math thrown in, which I don't remember.

It's a long story, but futures used to always trade at a premium to cash until about guessing 5 years ago, mostly because interest rates plunged. But "premium" (the difference between futures and cash) is a formula that includes interest rates, dividends payouts until that contract expiration, time to expiration, and maybe one other component. But there is a "fair value" formula, it can be Googled, too hard to explain. That cash and futures will not be equal until expiration, or if there is a close with the "premium" well above/below "fair value". Long discussion, talk to you sometime next week.

Mike

______________________________

D,

What David said about the cash S&P being made up of real transactions and various stocks being the leader and "being more meaningful " more important than futures, lends credence to the relevance of my indicators made up of the stocks traded in that index. It is like "getting down under the hood" like I think I heard you say. Anyway, just a plug for using the internals as another "old-fashioned, long forgotten" technical analysis, a great way to judge the markets strength/weakness looking makeup of the actual cash index.

Old time technical analysis guy,

Mike

DeWayne,

Here is a good link with most all of the info on the "premium" for the current contract and front months.

http://www.indexarb.com/fairValueDecomposition.html

They have been trading at a discount to cash for a number of years now, and mostly if not all because of interest rates going to almost 0. They used to always be at a premium to the cash index, thus the name "premium". The only times they were at a discount to the cash index would be for a very short time on a very bad day, or on what used to be the 4:15 PM settlement. I still watch to see where futures "settled" versus cash index, and whether or not they ended regular trading hours well above or well below the fair value.

Best,

Mike

Mike will be on the show this week to discuss this topic. Be sure to tune in and bring your questions.

Live Daily Radio Broadcast

Boston / Chicago / Las Vegas / Phoenix

Join us for Live Market Commentary

M-F @ 12pm Eastern w/

Michael B.

David Williams

Burton Schlichter

Mike Reed

and of course your host and founder -

DeWayne Reeves

Actively Participate in our Daily Broadcast

See our Charts Live in Real Time

Share your Point of View

Ask Questions

Simply Click this Link and you're instantly registered through February 1, 2013. You'll receive a friendly reminder email before the start of each day's broadcast and with a simple click you'll join the show from start to finish.

The Best Part?

It's Absolutely Free!

Live charts, Live Discussion, Real Trades, Real Money!

Learn

Technique - Strategy - Psychology

From Market Professionals who Trade for a Living!

5 year high,

5 year high,  cash market,

cash market,  fair value,

fair value,  premium

premium

Reader Comments