FOMC Day / High Volatility Alert

September 20, 2011 at 9:12 PM

September 20, 2011 at 9:12 PM As previously announced there was a live broadcast today but since I was out of the studio we were unable to produce our regular Emini Podcast. We will broadcast and record tomorrow.

FOMC DAYFed Funds Rate is a short-term rate objective of the Federal Reserve Board. The actual Fed Funds Rate is the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight. The real rate changes daily but is usually close to the target rate desired by the Federal Reserve. Adjustments to the Federal Funds Target Rate are made by the Federal Open Market Committee (FOMC) usually at regularly scheduled meetings; but can also be adjusted at any time with an emergency meeting. The rates reported below are based upon the Fed Funds Target Rates on the first day of each respective month. We report the Target Rate. The Effective Fed Funds Rate (Market Rate) can be found here.

Click here for historical graph of the Fed Funds Rate from 1955 to 2011.

|

Federal Funds Target Rate |

|||||||||||

| Month/Day | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Jan 1 | 6.50% | 1.75% | 1.25% | 1.00% | 2.25% | 4.25% | 5.25% | 4.25% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| Feb 1 | 5.50% | 1.75% | 1.26% | 1.00% | 2.25% | 4.50% | 5.25% | 3.00% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| Mar 1 | 5.50% | 1.75% | 1.25% | 1.00% | 2.50% | 4.50% | 5.25% | 3.00% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| Apr 1 | 5.00% | 1.75% | 1.25% | 1.00% | 2.75% | 4.75% | 5.25% | 2.25% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| May 1 | 4.50% | 1.75% | 1.25% | 1.00% | 2.75% | 4.75% | 5.25% | 2.00% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| Jun 1 | 4.00% | 1.75% | 1.25% | 1.00% | 3.00% | 5.00% | 5.25% | 2.00% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| Jul 1 | 3.75% | 1.75% | 1.00% | 1.25% | 3.25% | 5.25% | 5.25% | 2.00% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| Aug 1 | 3.75% | 1.75% | 1.00% | 1.25% | 3.25% | 5.25% | 5.25% | 2.00% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| Sep 1 | 3.50% | 1.75% | 1.00% | 1.50% | 3.50% | 5.25% | 5.25% | 2.00% | 0%-0.25% | 0%-0.25% | 0%-0.25% |

| Oct 1 | 3.00% | 1.75% | 1.00% | 1.75% | 3.75% | 5.25% | 4.75% | 2.00% | 0%-0.25% | 0%-0.25% | |

| Nov 1 | 2.50% | 1.75% | 1.00% | 1.75% | 4.00% | 5.25% | 4.50% | 1.00% | 0%-0.25% | 0%-0.25% | |

| Dec 1 | 2.00% | 1.25% | 1.00% | 2.00% | 4.00% | 5.25% | 4.50% | 1.00% | 0%-0.25% | 0%-0.25% | |

| Copyright 2011 MoneyCafe.com | |||||||||||

Source: Federal Reserve Board

A complete history of the specific change dates and rates for the Fed Funds Target Rate are found on the Federal Reserve website at http://www.federalreserve.gov/fomc/fundsrate.htm

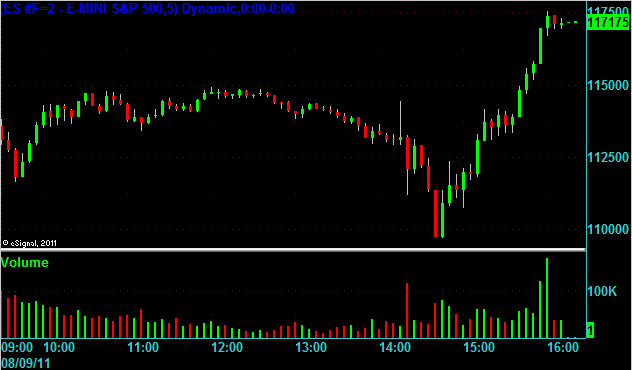

Here's how it looked last time

The Federal Reserve's objective for open market operations has varied over the years. During the 1980s, the focus gradually shifted toward attaining a specified level of the federal funds rate, a process that was largely complete by the end of the decade. Beginning in 1994, the FOMC began announcing changes in its policy stance, and in 1995 it began to explicitly state its target level for the federal funds rate. Since February 2000, the statement issued by the FOMC shortly after each of its meetings usually has included the Committee's assessment of the risks to the attainment of its long-run goals of price stability and sustainable economic growth.

What You Need To Know

The potential for extreme volatility is at its highest level on FOMC day. Unless you posses extraordinary talent our very best suggestion is to climb up into the stands and simply watch the action down on the field. Prior to the announcement there will be posturing. This activity can very often be misleading. One thing we have learned from Mike Reed is that the initial spike is often the direction where the market will ultimately trend to end the day. However, the initial spike is typically accompanied by several corrective moves which can easily take out a 10 - 20 - 30 point or larger stop. There simply is no good reason to put yourself or your trading account in harms way. Within 30-45 minutes after the announcement the market will in most cases fall into a more predictable and tradable trend. On Fed day, patience truly is a virtue.

Live Emini Trading Room Results

Advanced Training Class for dtPro

Monday September 26, 2011 @ 4:30PM EDT

This will be a Live Event. Class size is limited!

Registration is Required!

- We will download the dtPro Trading Platform step by step as a group.

- You will have a fully functioning trading platform installed on your computer.

- You will have live data feed for all markets including Emini's / Grains / Metals / Forex.

- We will help you properly set up your charts during the class.

- We will walk you through installing the CFRN Indicator set step by step.

- We will teach you how to properly use the Dom with bracket orders.

- You will then be able to mirror every trade we take in the Live Trading Room.

- We will answer all questions via voice chat during and after the class.

The Frustration and Confusion Ends Here!

The Frustration and Confusion Ends Here!

Everything you ever wanted to know about dtPro will be revealed.

To participate in this class register today by sending an email to education@cfrn.net

Space is on a first come, first serve basis.

Our goal is to give everyone in the class individualized assistance.

Shirt and Shoes Not Required!

Don't Delay - email education@cfrn.net today!

Put "Sign me up for Sept. 26th" in the subject line.

I will personally email you the registration link and course material.

If you have questions please call me @ 415-857-5654

Reader Comments